What is Medicare Part D? (Coverage Details for 2026)

What is Medicare Part D? Medicare Part D covers prescription drugs, which Original Medicare excludes. Plans start at $34 monthly and cover essential medications like cancer treatments. Medicare Part D plans vary, so review formularies, copays, and provider networks to secure the best prescription.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Medicare Broker

Adam Lubenow is a partner in his family business, Senior Advisor, which specializes in bringing clarity to the Medicare enrollment process and coverage options to ensure that clients are making informed decisions. Senior Advisors is licensed to help clients in over 40 states and has offices in Arizona and New Jersey. Prior to joining the family business, Adam spent his career with Verizon Busin...

Adam Lubenow

Updated September 2025

What is Medicare Part D? When you sign up for Medicare, you have the option to add a Part D plan for your medications. Original Medicare does not cover prescription drugs. Enrolling in Medicare prescription drug coverage ensures you don’t lose affordable access to necessary medications.

Part D isn’t required, but skipping it can be costly, there is a 1% penalty for every month you go without it. Scroll through this guide to learn how Medicare Part D works and discover how you can maximize your Medicare benefits.

- Medicare Part D covers prescriptions Original Medicare excludes

- Enrolling on time avoids penalties and ensures medication access

- Compare plans to find the best premiums, copays, and drug coverage

Call (855) 634-0435 to discuss Part D plans with a licensed insurance agent. You can also enter your ZIP code to learn more about your options from local Medicare Part D companies.

Medicare Part D Explained

Medicare Part D plans were created in 2006 to help seniors pay for expensive prescriptions. Prescription drugs are tiered based on class, with higher and specialty tiers having higher copayments.

What drugs are covered by Medicare Part D? Most providers update the formulary every year or whenever the FDA announces a recall. Prescriptions are tiered based on class, so copayments will vary based on which class of drug you need:

- Tier 1: Mostly generic prescriptions with the cheapest copayments.

- Tier 2: More preferred or brand-name drugs than Tier 1, so copayments are slightly higher.

- Tier 3: Mostly non-preferred, brand-name prescriptions with the highest copayments.

A specialty tier also exists for very expensive prescriptions or exemptions. If you can’t afford a certain prescription or want to find a better price, talk to your doctor about comparable drugs in lower tiers.

The government requires Medicare to offer at least two prescriptions in each class. However, there are over 700 different Part D plans, and each has a different formulary listing the covered prescriptions. Insurance companies can also change their formulary list at any time.

Before you renew coverage, shop around and compare the list of covered prescriptions to ensure that yours is still on it. Medicare Savings Programs (MSPs) can help reduce prescription costs to $11.

To qualify, you must meet the MSP income requirements. If you don’t, Medicare Supplemental Insurance, also known as Medigap, can cover some costs for an additional monthly premium and deductible.

If you can’t find your specific prescription on any plan’s formulary, you can ask for an exception. Your doctor or prescribing physician must write a supporting statement explaining why this specific medication is necessary.

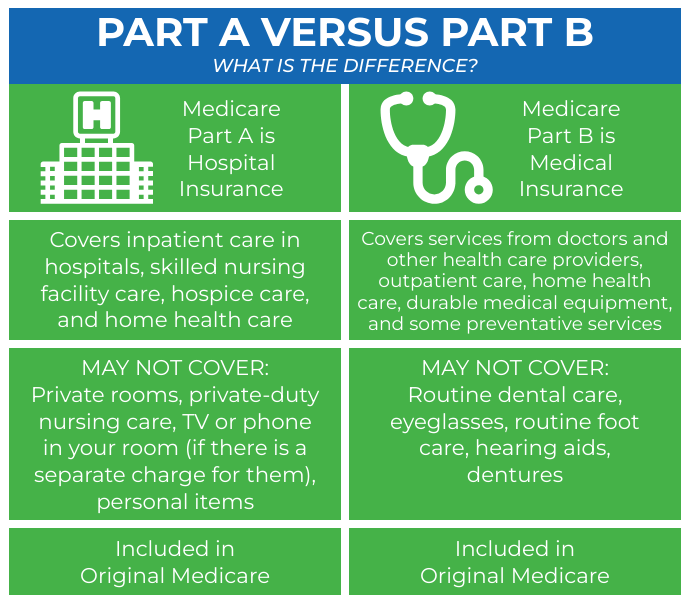

Original Medicare (Parts A and B) does not cover prescription drugs. It only covers medical costs and hospital stays.

Medicare Part D vs. Original Medicare

What is Medicare Part A? Part A is hospital insurance that pays for hospital stays and nursing home or hospice care. What is Medicare Part B? This part if your policy covers routine medical services and equipment.

Original Medicare is only designed for hospital and medical care and doesn’t cover prescriptions. Every Medicare Part D plan is required to cover a wide range of prescriptions, including cancer and HIV/AIDS treatments.

Read More: Millennial’s Guide to Health Insurance

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Comparing Medicare Part D Costs

Medicare Part D costs $34 a month for everyone, but the private insurance companies selling plans set their own deductibles.

Medicare Costs by Plan Type| Medicare Plan | Monthly Premium | Annual Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Part A | $0-$505 | $1,676 | N/A |

| Part B | $185 | $257 | N/A |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

| Medigap | $35-$488 | $0-$2,800 | $3,500-$7,500 |

Your monthly Part D premium does not include your prescription copayments. Out-of-pocket costs can vary based on where you live and the provider you choose.

Medicare Advantage vs. Medicare Part D Plan Comparison

What is Medicare Part C? Sometimes called Medicare Advantage Plans, Medicare Part C is a stand-alone health policy that combines Original Medicare (Parts A and B) with Medicare Part D.

With Medicare Advantage, you pay one premium for all your coverage instead of separate monthly plans for Part A, Part B, and Part D.

However, like Part D plans, Medicare Advantage plans have different formulary lists of brand-name and generic drugs. Compare multiple plans and companies online before you enroll.

How to Get Medicare Prescription Drug Coverage

There are two ways to get prescription drug coverage through Medicare: Medicare Part D or Medicare Advantage plans that include Part D. The good news is you enroll for either policy the same way on Medicare.gov.

Who is eligible for Medicare Part D? Part D is unavailable until you turn 65. There are specific enrollment periods around your 65th birthday when you can sign up for Medicare prescription drug coverage:

- Initial Enrollment Period (IEP): Starts three months before you turn 65 and ends three months after your birthday month

- Annual Enrollment Period (AEP): Between October 15 and December 7

- Open Enrollment Period (OEP): Between January 1 and March 31 for those who already have Medicare Advantage plans and need to change their coverage

- Special Enrollment Period (SEP): Must meet certain criteria to enroll, such as moving to another state or if your Medicare provider changes its coverage options.

Your IEP is the best time to sign up since you’ll have access to the lowest prices. Waiting to enroll can make it harder to get prescription coverage later. You’ll also pay a 1% penalty for every month you didn’t Part D. If you’re still working or otherwise insured by an employer’s or spouse’s insurance policy, you won’t pay any penalties.

Maximizing Benefits Under Medicare Part D

What is Medicare Part D? Part D is an essential add-on to Original Medicare for covering prescription drugs, which is not included in Parts A and B. Medicare Advantage plans often bundle prescription coverage, offering a more streamlined and potentially cost-effective solution if you’re looking for ways to finance what your health insurance won’t cover.

Enrolling in Medicare Part D can be done during specific periods around your 65th birthday. There are penalties for delayed enrollment unless covered by another insurance policy. Prescription costs are tiered, with higher tiers costing more.

Skipping Medicare Part D leads to late penalties and high drug costs. For example, a 1% fee is added for every month without coverage.

Jeff Root Licensed Insurance Agent

Discuss alternative medications with your doctors or seek plans with better coverage for prescriptions if copayments are too expensive.

Call (855) 634-0435 to speak with licensed insurance agents about your Medicare needs. Additionally, you can compare insurance companies online to find affordable Medicare Part D plans near you.

Frequently Asked Questions

What is the average monthly cost of Medicare Part D?

What is the monthly cost of Medicare Part D? Medicare Part D premiums cost $34 montly for all beneficiaries. Coverage options influence how much Medicare costs each month, affecting your overall budget. Explore further.

What is Medicare Part D, and how does it work?

Medicare Part D is an essential add-on to cover prescription drugs. Original Medicare doesn’t cover prescriptions, so you need to shop for Part D plans to help pay for your medication.

Does everyone pay for Medicare Part D?

Yes, everyone needs to enroll in Medicare Part D unless they have prescription coverage through another insurance plan. Enter your ZIP code to start comparing Medicare Part D plans near you.

How do you know if you have Medicare Part D?

Your Medicare Part D coverage is listed on your Medicare insurance card or Social Security benefits statement.

Can you add Medicare Part D at any time?

No, you can only sign up for Medicare during the Initial, Annual, or Special enrollment periods. Find out how to sign up for Medicare and ensure you enroll on time.

What will Medicare Part D not cover?

Medicare Part D doesn’t cover hospital stays or medical supplies. It only covers prescriptions listed on the plan’s formulary.

What is the maximum out-of-pocket for Part D?

The annual out-of-pocket maximum for Medicare Part D is $2,000.

Do you have to pay a deductible for Medicare Part D?

No, but you are responsible for paying any prescription copayment or coinsurance costs.

What is Medicare Part G?

Medicare Part G is a type of Medigap plan that provides supplement coverage to pay for excess costs and some Parts A and B copays.

Do you need Part D if you have Medicare Advantage?

No, because most Medicare Advantage plans include prescription coverage.

What are the disadvantages of Medicare Part D?

What happens if you refuse Medicare Part D?

Why was I automatically enrolled in Medicare Part D?

What does Medicare Part C cover?

Do you automatically get Medicare Part D?

Is it worth getting Medicare Part D?

What is the most popular Medicare Part D plan?

Can you drop your Medicare Advantage plan and go back to Original Medicare?

What is the penalty for not having Medicare Part D?

Why are people leaving Medicare Advantage plans?

Does Medicare cover 100% of hospital bills?

Does AARP have Part D plans?

Is Medicare Part D mandatory for seniors?

Can you get Medicare Part B for free?

What is the best supplemental insurance when you’re on Medicare?

Why are hospitals refusing Medicare Advantage plans?

Why do you need Medicare Part C?

Is Medicare Part D automatically deducted from Social Security?

Is Medicare Part C free for seniors?

Can you drop your employer’s health insurance and go on Medicare Part B?

What is the best Medicare plan that covers everything for seniors?

Why would someone not have Medicare Part D?

Why is Social Security no longer paying Medicare Part B?

Does everyone have to pay $170 a month for Medicare?

How much is taken out of your Social Security check for Medicare?

How do you qualify for $144 back from Medicare?

How do you get your Part D penalty waived?

What drugs does Medicare Part D not cover?

How much will you pay for Medicare when you turn 65?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.