Medicare Coverage & Eligibility in 2026

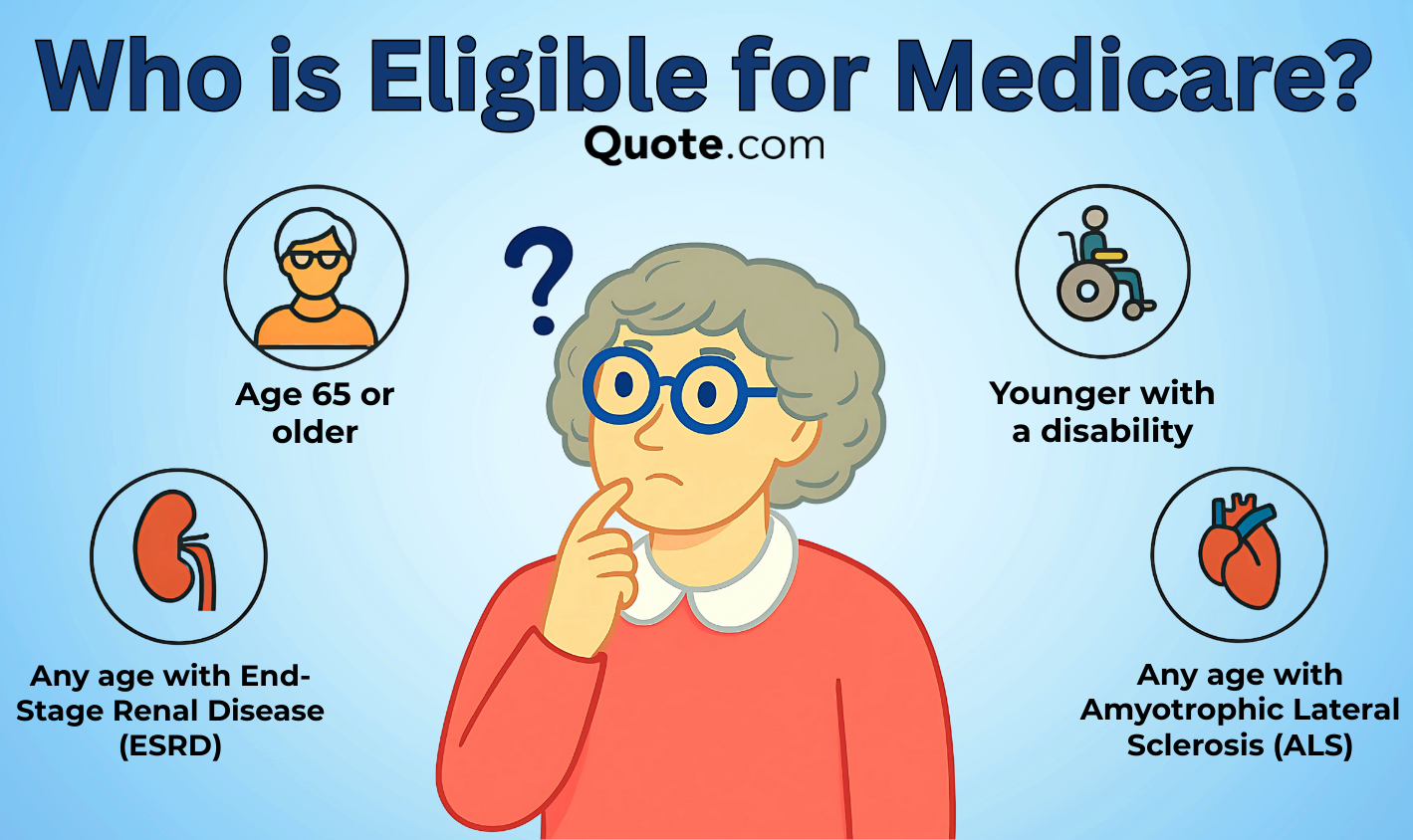

Understand your Medicare coverage and eligibility to avoid a 1% monthly late fee on Medicare Part D premiums. Most people 65 and older qualify for Medicare coverage. If you were diagnosed with ESRD, ALS, or a qualifying disability, you’re automatically eligible for Medicare insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated September 2025

When researching Medicare coverage and eligibility, it is important to know that signing up late for Medicare could incur late penalties for parts of Medicare.

Read on for an expert guide to Medicare that breaks down your choices, as well as how to determine your eligibility for Medicare.

- Medicare coverage eligibility starts when you turn 65

- People under 65 with disabilities or medical conditions may qualify for Medicare

- People can choose among Medicare Parts A, B, C, and D

Speaking to an insurance representative can help you determine your eligibility status and what Medicare plan is best. Call (855) 634-0435 to speak to a licensed insurance agent or enter your ZIP to learn more about your Medicare options.

Determine if You Meet Medicare Eligibility Requirements

Wondering how to determine eligibility for Medicare? Almost anyone over 65 years of age can sign up for Medicare insurance.

While most Medicare-eligible customers must be over age 65, there are certain exceptions for those younger than 65 who have qualifying disabilities or medical conditions.

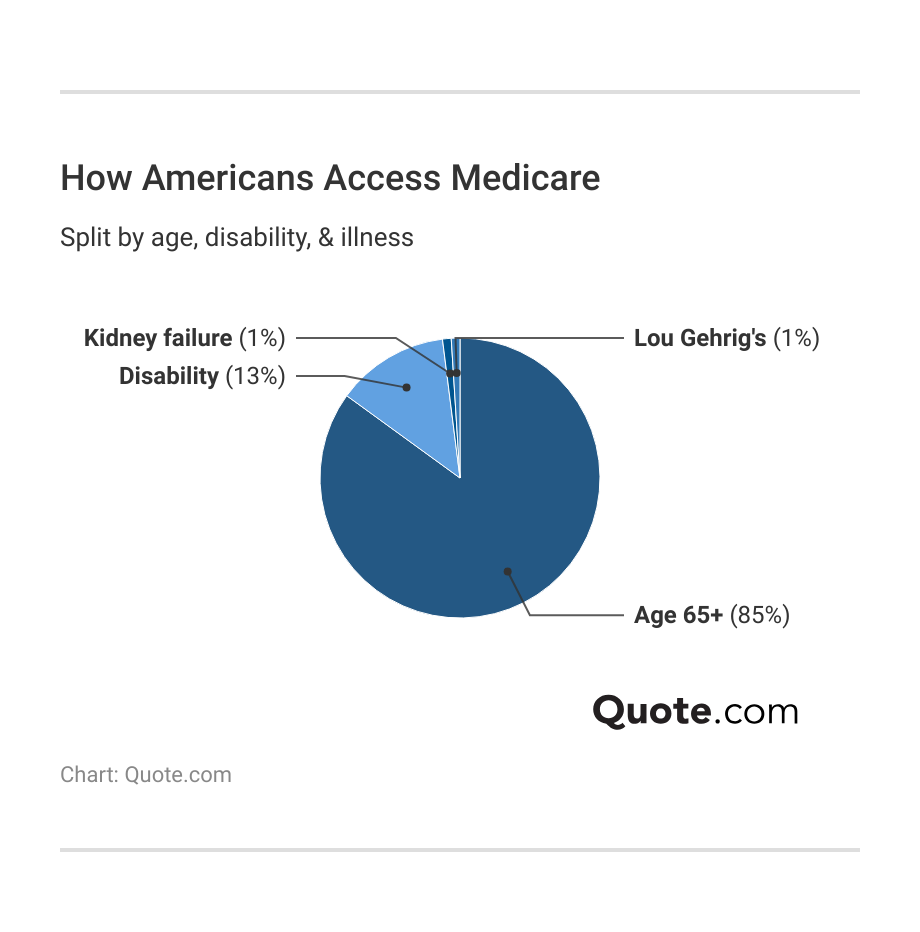

While 85% of Medicare enrollees are over age 65, 13% are under age 65 because they have a disability that qualifies them for Medicare.

For example, customers with end-stage renal disease (ERSD) can qualify for Medicare coverage, regardless of their age.

Besides age, disability, and medical conditions, customers must meet other requirements to qualify for Medicare insurance.

For example, customers must be either a U.S. citizen or a legal permanent resident for at least five years (Learn More: Who is eligible for Medicare?).

Medicare Eligibility Requirements| Factor | Details |

|---|---|

| Age | 65 or older in most cases |

| Disability | Under 65 if receiving SSDI for 24 months |

| Medical Conditions | Any age with ESRD (End-Stage Renal Disease) or ALS (Amyotrophic Lateral Sclerosis) |

| Residency | U.S. citizen or legal permanent resident for at least 5 years |

| Work History | 40 quarters (10 years) of Medicare-covered employment for premium-free Part A |

| Special Circumstances | May qualify earlier if spouse meets work requirements |

Who is not eligible for Medicare? Anyone under 65 without a qualifying medical condition, but another important factor is work history.

You won’t be eligible for Medicare insurance if you didn’t pay enough into Social Security taxes while employed. However, some people may still qualify if their spouse meets certain work requirements.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

When to Sign Up for Medicare

When you are turning 65, you have an initial enrollment period that provides you time to choose the Medicare policy that best suits you without invoking any late penalties (Read More: How to Sign up for Medicare).

It is important to note that delaying Medicare coverage can drive up the cost of monthly charges, so the longer you wait, the more you will pay.

Medicare Enrollment Periods: Key Details| Period | Timeframe | Purpose |

|---|---|---|

| Initial Enrollment Period (IEP) | 7-month window: starts 3 months before the month you turn 65, includes your birthday month, ends 3 months after | First chance to sign up for Parts A, B, and D without penalty |

| General Enrollment Period (GEP) | Jan 1 – Mar 31 each year | Enroll in Parts A and/or B if you missed IEP. Coverage starts July 1 |

| Special Enrollment Period (SEP) | Varies; triggered by events like losing employer coverage | Enroll without penalty outside IEP/GEP |

| Annual Enrollment Period (AEP) | Oct 15 – Dec 7 each year | Make changes to Advantage or Part D plans |

| Medicare Advantage Open Enrollment | Jan 1 – Mar 31 each year | Switch Advantage plans or return to Original Medicare |

Medicare enrollment is once a year, unless you meet special exceptions for applications outside of the regular enrollment period.

For example, if you turn 65 outside of the enrollment period, you can still apply for coverage. When applying for Medicare insurance, it can be helpful to familiarize yourself with some common enrollment and policy terms.

Key Medicare Terms to Know| Term | Description |

|---|---|

| Initial Enrollment | Sign up during the 7-month period around your 65th birthday to avoid penalties. |

| Late Penalties | Delaying Part B or D without other coverage adds permanent monthly surcharges. |

| Special Enrollment | Extra time to enroll after losing employer or group coverage, no penalty. |

| Open Enrollment | Oct. 15–Dec. 7 annually to switch Advantage or drug plans. |

| Medigap Window | 6 months after turning 65 and joining Part B — best rates, guaranteed approval. |

| Costs Not Covered | Expect to pay deductibles, coinsurance, and for excluded services. |

You can also apply for coverage outside of general enrollment if you meet one of the special circumstances outlined by Medicare. Examples would be if you lost your employee health insurance or were diagnosed with ALS or ESRD.

Understanding Your Medicare Coverage Options

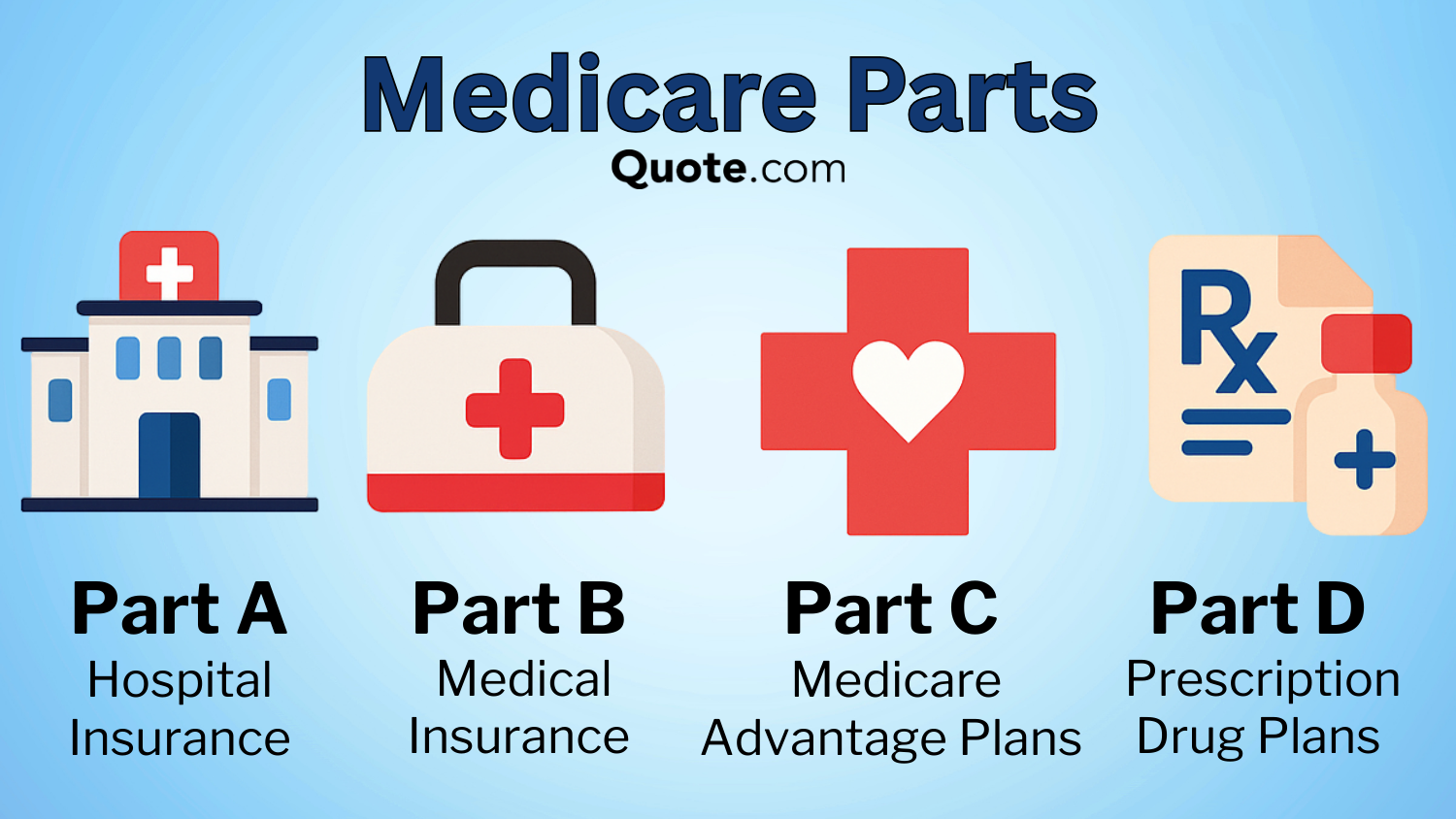

Medicare is a federal health insurance program composed of several parts, each providing different types of coverage.

Understanding what each part covers is essential if you want to buy the right Medicare plan. For example, when you sign up for Medicare, you may be automatically enrolled in Part A, which is hospital insurance.

There are three other parts to Medicare: Part B, Part C, and Part D. Part B is important for medical insurance, which would help cover outpatient care, doctor visits, and certain medical supplies.

Medicare Part D is another useful coverage that helps cover prescription drug costs, which is important for customers on multiple medications.

Original Medicare Plans include Medicare Part A and Medicare Part B, which cover hospital stays and medical visits.

Michelle Robbins Licensed Insurance Agent

Part C is known as Medicare Advantage, which is a more comprehensive plan than Original Medicare plans that only include Part A and Part B.

Part C typically includes hospital insurance, medical insurance, and prescription drug coverage in one convenient policy with one fixed premium.

Wondering which is better, original Medicare or Medicare Advantage? Read our guide on Medicare Advantage vs. Original Medicare to see which fits your lifestyle.

If having prescription drug coverage is important for you, for example, you may not want to carry just an Original Medicare plan.

Comparing Medicare Coverage Costs

How much does Medicare cost? Just like other insurance plans, Medicare has deductibles and copays that have to be paid.

The medical costs covered by Medicare depend on what Medicare plan you choose, as copays and premiums will vary depending on the Medicare plan.

Medicare Costs and Coverage by Part| Part | Costs | Coverage |

|---|---|---|

| Part A – Hospital | Days 1-60: $0 deductible Days 61-90: $419/day After Day 90: $838/day | Hospital, skilled nursing, hospice, limited home health |

| Part B – Medical | $257 deductible, then 20% coinsurance | Outpatient care, doctor visits, equipment |

| Part C – Advantage | Varies by plan | Combines A & B (often D), may include extras |

| Part D – Prescriptions | Premiums vary; 1% penalty/month if late | Prescription drugs |

For example, Part A costs $0 for a hospital stay of 60 days or less, but it charges a daily fee for any day after that.

Copays with Medicare Part A will also depend on the length of the hospital stay. The longer a hospital stay is, the more you pay in copays.

Medicare Premium, Copay, & Coinsurance Breakdown| Part | Premium | Copay | Coinsurance |

|---|---|---|---|

| Part A – Hospital | $0 for most | Skilled Nursing: Days 1-20: $0 Days 21-100: $210/day | Days 1-60: $0 Days 61-90: $419/day After 90 Days: $838/day |

| Part B – Medical | Varies; penalty if late | N/A | 20% after deductible |

| Part C – Advantage | Varies by plan | Varies by plan | Varies by plan |

| Part D – Prescriptions | Varies by plan | Varies by plan | Varies; 1% penalty/month if late |

| Medigap – Supplement | Extra premium; varies by plan | Covers Medicare copays | Covers deductibles & coinsurance (depends on plan) |

Medicare Part B is the only plan without a copay, but you must meet the Medicare deductible before coverage applies.

Medicare Advantage costs will vary by plan and by state, so it’s important to compare Medicare insurance quotes online to get an idea of costs in your area.

If you want extra assistance with payments, you may want to look into Medigap supplemental insurance (Medigap) coverage.

Medigap coverage can help cover deductibles and copays on Medicare coverage. Not everyone will qualify for Medigap, as there is a maximum income limit.

Speaking with a licensed insurance agent can help you navigate Medicare. Call (855) 634-0435 to speak with someone today or enter your ZIP in our free tool to get quotes.

Frequently Asked Questions

What are the four factors that determine Medicare eligibility?

The general factors in determining eligibility for Medicare are age, citizenship/residency, medical conditions, and work history.

At what age does a woman qualify for Medicare?

Women and men both qualify for Medicare at age 65.

Who isn’t eligible for Medicare?

Wondering what disqualifies a person from Medicare? Medicare is not available to those under 65 and who aren’t U.S. citizens or haven’t been a legal U.S. resident for at least five years.

What is the maximum you can make to qualify for Medicare coverage?

There is no maximum for Medicare eligibility, but you will have to make under a certain amount to qualify for Medicare Savings Programs (MSPs).

What are the three types of patients eligible for Medicare?

Wondering what three ways a person can qualify for Medicare? Patients with disabilities, ESRD, or ALS can qualify for Medicare.

What are the reasons you can be denied Medicare coverage?

You can be denied Medicare if you are under 65 and don’t meet one of the special exceptions or if you don’t meet the residency or citizenship requirements.

Can I get Medicare at 55?

The Medicare eligibility age chart provides coverage only to those 65 and older, unless they meet medical or disability requirements at an earlier age. If you have a qualifying medical condition or disability, you can get Medicare at 55 or earlier.

Do I have to sign up for Medicare if I have private insurance?

No, you may not have to sign up for Medicare if you have group health insurance through your employer. Learn more about Medicare eligibility and employer insurance in our complete guide to health insurance.

Why are you forced to get Medicare at 65?

You are not forced to get Medicare at 65, but signing up later results in late penalty fees. If you are already receiving Social Security benefits, you may be automatically enrolled.

Do I really need supplemental insurance with Medicare?

You may want supplemental insurance with Medicare if you anticipate having large medical bills, or add on extras like Medicare Part D. Call (855) 634-0435 to speak with a licensed insurance agent about your budget and options, or enter your ZIP in our free tool to get quotes.

Does Medicare cover 100% of hospital bills?

What is the best Medicare plan that covers everything for seniors?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.