Types of Life Insurance in 2026

The seven main types of life insurance include term, whole, universal, variable, variable universal, final expense, and group life. Term policies start at $30 a month, while whole life generally starts around $380 per month. Compare quotes from top companies to find the best life insurance for your goals.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated September 2025

The main types of life insurance are term, whole, universal, variable, variable universal, final expense, and group insurance. Term life is most popular for affordability, while whole life offers permanent coverage with cash value. Group life and final expense policies are also common low-cost options.

- Term life is the cheapest type of life insurance, starting at $30 per month

- Whole life insurance is more expensive, but coverage lasts for a lifetime

- You may be eligible for group life insurance through your employer

Average life insurance rates range from $30–$40 a month for term life, to $380–$475 monthly for whole policies. Knowing how to get life insurance quotes can help you compare multiple types of life insurance within your budget. If you’re ready to shop for coverage today, enter your ZIP code in our free comparison tool.

Common Types of Life Insurance

Life insurance covers many financial needs and life situations. Term life offers low-cost temporary protection, while whole and universal life provide permanent coverage with savings benefits. Variable and variable universal policies also include investing options for people who are willing to take on risk.

Life Insurance Overview by Coverage Type| Policy | Description | Key Features | Best for |

|---|---|---|---|

| Term Life | Temporary coverage for a fixed period (e.g., 10, 20, or 30 years) | Low premiums, no cash value, expires after the term ends | Budget-conscious individuals, short-term needs |

| Whole Life | Permanent coverage with guaranteed cash value and fixed premiums | Lifetime protection, cash value growth, higher cost | Long-term dependents, estate and legacy planning |

| Universal Life | Flexible permanent policy with a cash value component | Adjustable premiums and coverage, interest-bearing cash value | Those needing lifelong coverage with flexibility |

| Variable Life | Permanent coverage with investment-linked cash value | Market-based cash value growth, potential for gains and losses | Investment-minded individuals with risk tolerance |

| Variable Universal Life | Hybrid of universal and variable life insurance | Flexible premiums, investment options, no guaranteed returns | Financially savvy buyers seeking growth and control |

| Final Expense | Simplified permanent policy for end-of-life costs | Small death benefit, no medical exam, easy qualification | Seniors, individuals with limited coverage needs |

| Group Life | Employer or organization-sponsored life insurance | Limited coverage, often free or low-cost, not portable | Employees, basic or supplemental coverage |

Seniors often choose final expense coverage because it provides an affordable way to handle end-of-life costs such as funeral expenses, medical bills, and outstanding debts, ensuring their families aren’t burdened financially. See more reasons to buy life insurance.

- Life Insurance Coverage

Match coverage to financial goals, balance cost with protection, and decide if cash value matters most. Group life can supplement, but personal coverage offers security.

Jeff Root Licensed Insurance Agent

Seeing policies side-by-side can help you balance cost, coverage and flexibility. It ensures you choose a plan that fits both your budget and long-term goals. This way, you avoid gaps in protection while supporting smart financial planning for every life stage.

Term Life Insurance

Term life insurance covers you for a specific amount of time, typically 10, 20, or 30 years, and pays a tax-free death benefit to your beneficiaries if you pass away during that time. Designed purely for protection, without any cash value component, term life is the most affordable option for many families.

Premiums are generally low and fixed for the chosen term, but coverage ends when the policy expires. Some providers offer different types of life insurance policies that extend the term or convert it to a permanent plan, but often at a higher cost.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance. It provides lifetime coverage, has level premiums, and a guaranteed and cash value that grows on a tax-deferred basis and can be borrowed against or withdrawn as needed. Some policies also pay dividends, which are like earning more interest.

Whole life insurance is best for those with lifelong dependents or estate planning needs who want predictable costs, guaranteed protection, and the ability to provide lasting financial security for a chosen life insurance beneficiary, though it is more expensive than term life and may yield lower returns.

Universal Life Insurance

Universal life insurance is a permanent policy with flexible ways to build cash value. Policyholders can adjust premiums, with part going into an interest-earning account. The cash value can be borrowed, withdrawn, used for future premiums, and death benefits may vary by insurer and policy.

Universal life provides tax-deferred growth and lifetime protection but is more complex and costly than term life, with a risk of lapsing if underfunded. It works best for people who want lifetime coverage and already hold other investments. These strategies can also be a good complement to broader financial plans.

Variable Life Insurance

This type of permanent life insurance provides lifelong coverage and a guaranteed death benefit. It also includes an investment account similar to mutual funds. Cash value and sometimes the death benefit can grow with market gains but also carry the risk of loss.

Policyholders manage investments, enjoy tax-deferred growth, and can borrow or withdraw funds. Variable life offers higher growth potential than whole life but also higher fees and market risk. It’s ideal for those wanting lifelong coverage and comfortable with investment fluctuations.

Variable Universal Life Insurance

Variable universal life (VUL) is a permanent policy that combines life insurance protection with investment options for cash value. Earnings accumulate tax-deferred, and the policyholder can withdraw cash value through loans or withdrawals. Such moves could diminish the death benefit or have charges.

VUL policies provide more flexibility and growth potential than other types of life insurance, but also carry the risk of faring worse if investments underperform. VUL doesn’t offer guaranteed returns, so it’s best for sharp investors who want permanent coverage and growth.

Read More: The Ultimate Insurance Cheat Sheet

Final Expense Life Insurance

Final expense life insurance offers permanent coverage for end-of-life costs like funerals, medical bills, and small debts, with payouts from $2,000 to $40,000. Policies feature simplified underwriting and usually require no medical exam. This makes them a common choice of life insurance for seniors or those with health issues.

Premiums are fixed and affordable, though coverage is higher per dollar compared to traditional policies. This type of insurance is best suited for individuals who want lifelong protection, much like a life insurance annuity, to relieve loved ones in the event of misfortune.

Group Life Insurance

Group life insurance is typically offered through employers and covers multiple people under one contract at little to no cost with minimal requirements. Most are structured as term life, meaning coverage lasts only while the person is employed or part of the group. These policies generally do not build cash value.

Group life is cheap basic protection, but it is most effective when used as a supplement to your personal coverage. Resources like how to finance what your health insurance won’t cover can help employees plan for extra protection beyond basic benefits.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Life Insurance Costs

When it comes to cost, a term life policy is much cheaper. The average rate for a 20-year term policy is $30-$40 a month, whereas a guaranteed whole life policy that provides cash value will cost between $380-$475 a month. Transamerica and AIG are among the cheapest life insurance companies for both types of life insurance.

Term vs. Whole Life Insurance Monthly Rates by Provider| Company | 20-Year Term | Whole Policy |

|---|---|---|

| $32 | $390 | |

| $36 | $455 | |

| $33 | $472 |

| $31 | $425 | |

| $34 | $410 | |

| $40 | $465 | |

| $39 | $475 | |

| $37 | $400 |

| $38 | $435 | |

| $30 | $380 |

State Farm offers term life insurance at about $38 per month and whole life coverage at $435, near the market average. Its competitive pricing, financial stability, customer service, and local agents make it stand out from other providers, despite a higher price point. Learn more in our State Farm insurance review.

Term life is the most affordable option, while whole life costs more. The best ways to save include staying healthy, purchasing early, and comparing quotes online.

Michelle Robbins Licensed Insurance Agent

MassMutual also offers competitive options, with average term policies around $31 per month and whole life starting near $425 monthly. This makes it a strong choice for those comparing term vs. whole life insurance across top providers. Find out more in our MassMutual insurance review.

Whole life insurance is more expensive and provides lifetime coverage with a cash value, while term life is cheaper for temporary needs. Term accounts for 40% of purchases, due to its low cost and ease, versus 25% for whole life. It’s perfect for younger families looking for inexpensive protection in the years of mortgage debt or child raising.

Whole or universal life insurance is more expensive but provides permanent coverage, guaranteed cash value, and stability for estate planning and legacy goals. Comparing life insurance types helps you see how the average cost of life insurance, coverage length, and flexibility match your financial needs and family priorities.

How to Choose the Right Life Insurance Coverage for You

When considering purchasing life insurance, when you do need it consider exactly how much coverage you will need. Take into account final expenses, debts, income replacement needs, education funding requirements, retirement costs and the need for an emergency fund.

Determining Life Insurance Coverage Needs: Costs to Calculate| Expense | What to Consider |

|---|---|

| Final Expenses | Funeral, burial, medical bills, probate costs |

| Debt Repayment | Mortgage, student loans, car loans, credit cards |

| Income Replacement | Years of income needed to support dependents |

| Children’s Education | Tuition, books, living expenses |

| Spouse’s Retirement Fund | Contributions lost due to your passing |

| Emergency Fund Buffer | 6-12 months of living expenses |

| Existing Assets | Subtract savings, investments, existing life insurance |

| Employer Coverage | Evaluate if employer life insurance is enough (usually 1-2× salary) |

These are the factors that help determine if term life is adequate for a short-term need such as income replacement or mortgage payment. Whole or universal life is lifetime protection for long-term needs. This permanent coverage also accrues cash value, which can help with estate planning and financial legacy.

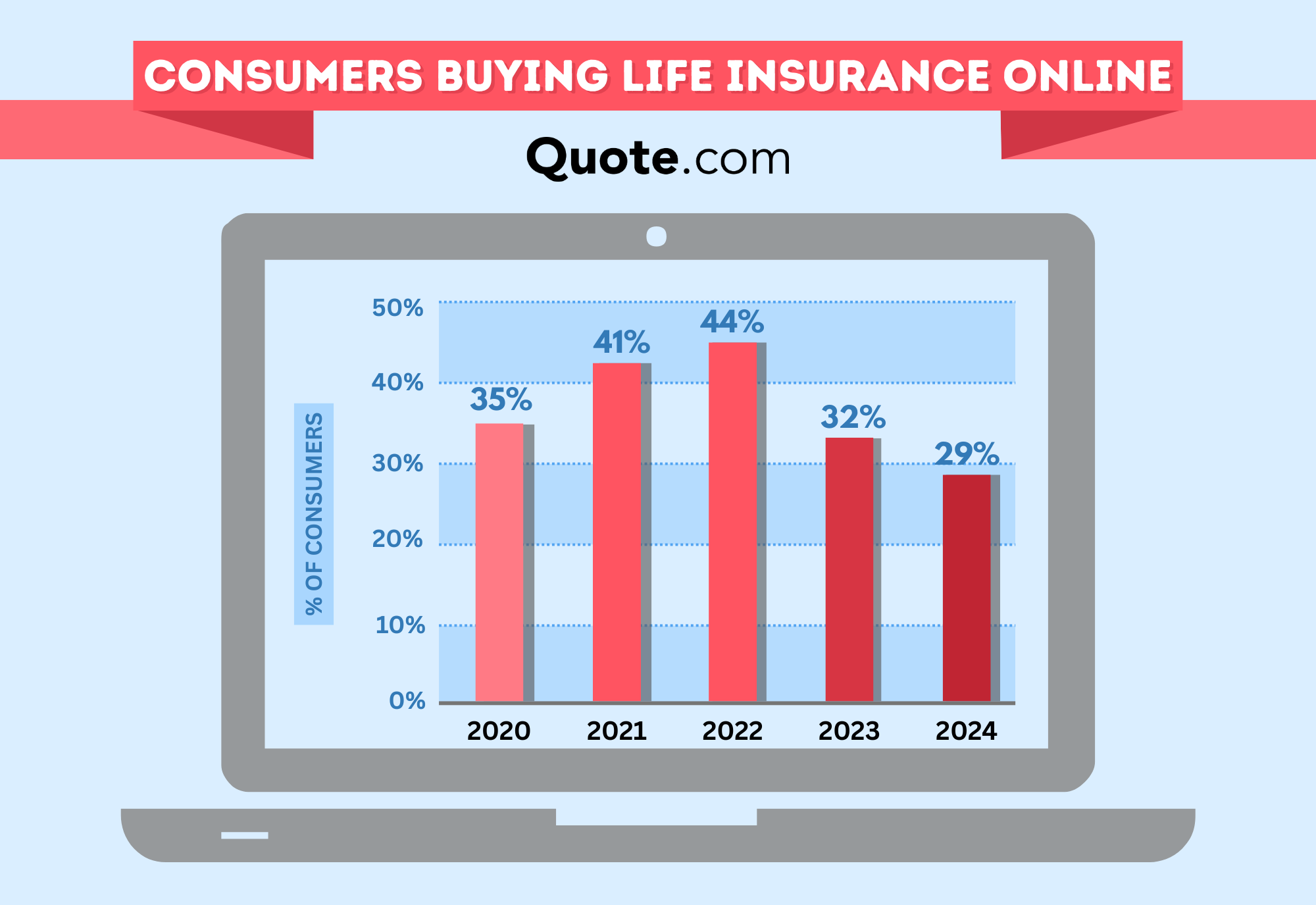

Purchasing life insurance is easier than ever with online tools offering instant quotes and easy-to-use applications. Approvals, in many cases, are granted without a medical exam. Buying online is one of the easiest and most affordable ways to buy coverage.

This change has eliminated the old obstacles of major paperwork and in-person meetings, and enables families and individuals to more quickly and easily purchase policies that fit their financial and protection wishes, as highlighted in one quote that convinced me to get life insurance.

Get the Best Life Insurance Policy for Your Needs Today

Understanding the seven main types of life insurance including term, whole, universal, variable, variable universal, final expense, and group helps match coverage to your goals. Options include cheap, temporary protection at the low end and lifetime coverage with cash value or growth at the high end.

Pros & Cons for Each Type of Life Insurance Coverage| Policy | Pros | Cons |

|---|---|---|

| Term Life | Affordable premiums, simple to understand | No cash value, expires after term |

| Whole Life | Lifetime coverage, guaranteed cash value | Higher premiums, lacks flexibility |

| Universal Life | Flexible premiums, interest on cash value | Complex, may lapse if not funded |

| Variable Life | Investment growth, tax-deferred benefits | Market risk, requires active management |

| Variable Universal Life | Premium flexibility, investment growth | No guaranteed returns, costly, complex |

| Final Expense | Easy qualification, affordable small coverage | Low coverage, high cost per dollar |

| Group Life | Free or low-cost, no medical exam | Limited coverage, not portable after job ends |

Buying the right type of life insurance plan will provide financial security for your family and loved ones by covering debts, expenses, and funeral costs. Our life insurance guide explains how different types of affordable short-term or permanent coverage offer peace of mind and protection from unexpected burdens.

Choosing the right type of life insurance depends on balancing cost, protection, and long-term needs. Enter your ZIP code into our free comparison tool to explore affordable life insurance rates today.

Frequently Asked Questions

What is the most common form of life insurance?

The most common form of life insurance is term life, chosen for its affordability and simplicity. Term life provides temporary protection, usually 10–30 years, with fixed low premiums.

Which is the most expensive type of life insurance?

Whole life insurance is generally the most expensive type, with monthly premiums often ranging from $380 to $475, because it provides lifelong coverage and builds guaranteed cash value. Single premium life insurance is also pricey, offering permanent coverage funded by a one-time lump sum.

What’s the best type of life insurance to get?

The best life insurance for you will depend on your needs. Term life is cheapest for temporary protection, while whole or universal life works best for those who want permanent coverage with a cash value. Enter your ZIP code to find life insurance that doesn’t break the bank.

What are the seven principal types of life insurance?

The seven types of life insurance are term life, whole life, universal whole life, variable whole life, variable universal, final expense coverage, and group life insurance.

What is the safest type of life insurance?

The safest life insurance is whole life insurance because it provides guaranteed lifetime coverage, fixed premiums, and a cash value that grows predictably. Though it costs more than other options, start comparing insurance plans to get coverage that works for you.

Who is the best beneficiary for life insurance?

The best beneficiary for life insurance is usually someone who depends on your income, such as a spouse, children, or other close family members, though you can also name a trust or estate if it better protects your loved ones’ financial needs.

How much life insurance do I need?

How much life insurance do you need? Most experts recommend life insurance coverage equal to 10–15 times your annual income. For example, if you earn $60,000 per year, you may need $600,000–$900,000 in coverage to replace income, pay debts, fund education, and secure your family’s future.

Which types of life insurance are permanent?

Permanent life insurance includes whole life, universal life, variable life, and variable universal life. These policies last a lifetime as long as premiums are paid.

Should I buy term or whole life insurance?

Whether you should buy whole life or term life insurance depends on your goals. Term life is best if you only need temporary coverage for needs like a mortgage or raising children. Whole life is better if you want lifetime protection, guaranteed cash value, and estate planning benefits, though it costs much more.

What are the three main components of life insurance premiums?

Life insurance premiums include mortality charges, administrative expenses, and cash value or investment contributions.

What is the Option Three death benefit on life insurance?

What is critical three life insurance?

Does life insurance cover illness?

What life insurance policy covers everything?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.