Is home insurance required?

Home insurance isn't required by law, but many mortgage lenders and homeowners' associations make it a condition of ownership. Regardless, carrying homeowners insurance is the best way to protect your property and belongings. Policies with $200,000 in coverage start at just $72 per month.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated September 2025

Is home insurance required? Homeowners insurance is not required by state laws, but your mortgage lender will require home insurance to protect their assets. Your homeowners association (HOA) may also require a level of home insurance coverage.

- State laws do not require homeowners insurance on homes

- Mortgage lenders and HOAs often require home insurance

- Renters insurance is not legally required, but often mandated by landlords

Even if you don’t have a mortgage, having insurance on your home is still a smart choice, as it protects your assets and belongings. Read on to learn about home insurance requirements, from eligibility to costs, the cheapest home insurance companies, and much more.

Looking for protection for your home? Enter your ZIP in our free tool to compare home insurance quotes from companies today.

Understanding Home Insurance Requirements

Does everyone need house insurance? The answer is that while no state laws mandate homeowners insurance. However, you will likely have conditions from your mortgage lender or HOA that require you to have insurance on your home.

So if you are asking is home insurance required on Reddit or other sites, the answer is almost always yes if you have a mortgage on your home, as home insurance should be a requirement in your contract.

Home Insurance Requirements by Mortgage & Status| Status | Required? | Reason |

|---|---|---|

| Homeowners associations (HOAs) or condo boards | ❓ | If your property is part of an HOA or condo, the bylaws may mandate insurance (even if you don’t have a mortgage) |

| Mortgage with lender | ✅ | Lender requires insurance to protect their investment |

| No mortgage (own home outright) | ❌ | Not legally required but recommended for protection |

| Renting (tenant) | ❌ | Not required by law, but landlords often require renters insurance |

| Mortgage with specific risks (flood, earthquake zones) | ❓ | Special insurance (flood, earthquake) may be required in high-risk areas |

You may also be required to have high-risk homeowners insurance on your home if you live in an area that is a high-risk for flooding, wildfires, or other natural disasters (Read More: Does homeowners insurance cover wildfires?).

Even if you rent, your landlord may require you to carry renters insurance. While home and renters insurance aren’t mandated by state law, they are often required in specific situations.

Determining Eligibility for Home Insurance

Not everyone will have an easy time securing home insurance, due to risk factors like location, credit history, property type, and more.

For example, if you live in an area where wildfire claims are common, you may have trouble securing insurance (Learn More: How to File a Home Insurance Claim After a Wildfire).

Home Insurance Requirements| Requirement | Description |

|---|---|

| Ownership Status | Must own the property or have legal rights; renters need renters insurance |

| Property Type | Coverage depends on home type (single-family, condo, townhouse, etc.) |

| Mortgage Status | Lender usually requires insurance; optional but recommended if no mortgage |

| Property Condition | Home should be in good repair; major risks may need fixing |

| Home Value & Coverage Amount | Coverage set based on home and belongings’ value |

| Location | High-risk areas may need extra or special coverage |

| Credit Score | Good credit may be required and can lower premiums |

| Previous Claims History | Frequent claims can increase rates or affect eligibility |

| Home Security Measures | Security systems may give discounts or extra benefits |

| Age of Home | Older homes may need inspections or updates |

| Legal Requirements | Local laws may mandate specific coverage (flood, earthquake) |

If your eligibility for home insurance is affected by risk factors, you will have to shop around more to find an insurance provider that will insure your home.

You can also take some measures to improve your eligibility for home insurance and make it less likely that you will be rejected by insurers.

Improving home insurance eligibility can involve anything from increasing your credit score to updating older homes with necessary safety measures after an inspection.

Michelle Robbins Licensed Insurance Agent

For example, if you live in an area prone to wildfires, following safety protocols like clearing brush around the house and storing combustible materials a safe distance away from the home can help reduce your risk to insure.

If you are still rejected by home insurance companies due to area risks, you can check if your state offers a state-run home insurance program, such as the California FAIR plans.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Home Insurance Rates

How much is homeowners insurance? Home insurance rates vary drastically based on several factors, even if customers live on the same street.

Personal factors like credit score affect house insurance rates, as well as the type of home dwelling and the location of the dwelling.

Even the home security you have on your home can affect what you pay, with more extensive security features on your home lowering rates.

This is because homes with more advanced security features are less likely to be broken into and have valuable goods stolen.

Top Factors Affecting Home Insurance Rates| Factor | Rank | Reason |

|---|---|---|

| Location | #1 | Raises premiums in high-risk areas |

| Home’s Age & Condition | #2 | Raises premiums for older homes |

| Coverage Amount | #3 | Raises premiums with higher coverage |

| Claims History | #4 | Raises premiums with frequent claims |

| Deductible Amount | #5 | Lowers premiums but raises claim costs |

| Credit Score | #6 | Raises premiums with lower credit score |

| Home Security | #7 | Lowers premiums with security systems |

The number of claims you have on record can also affect rates, just like with any type of insurance, whether auto insurance or pet insurance.

The monetary value of your home and the home insurance provider you choose will also have an impact on your monthly home insurance costs.

Home Insurance Monthly Rates by Dwelling Coverage| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $132 | $167 | $210 | $292 |

| $142 | $178 | $223 | $308 |

| $156 | $195 | $244 | $338 |

| $138 | $171 | $213 | $294 |

| $113 | $141 | $177 | $246 | |

| $122 | $153 | $191 | $267 | |

| $72 | $90 | $111 | $174 | |

| $75 | $91 | $121 | $184 | |

| $74 | $95 | $121 | $187 | |

| $160 | $199 | $234 | $312 |

Who gives the cheapest homeowners insurance? Some home insurance companies that may be more affordable for homes are Kemper, Westfield, or Union Mutual.

Companies that may cost a little bit more to purchase home insurance from include Cincinnati Insurance Companies and American Family Insurance.

Home Insurance Rates by State

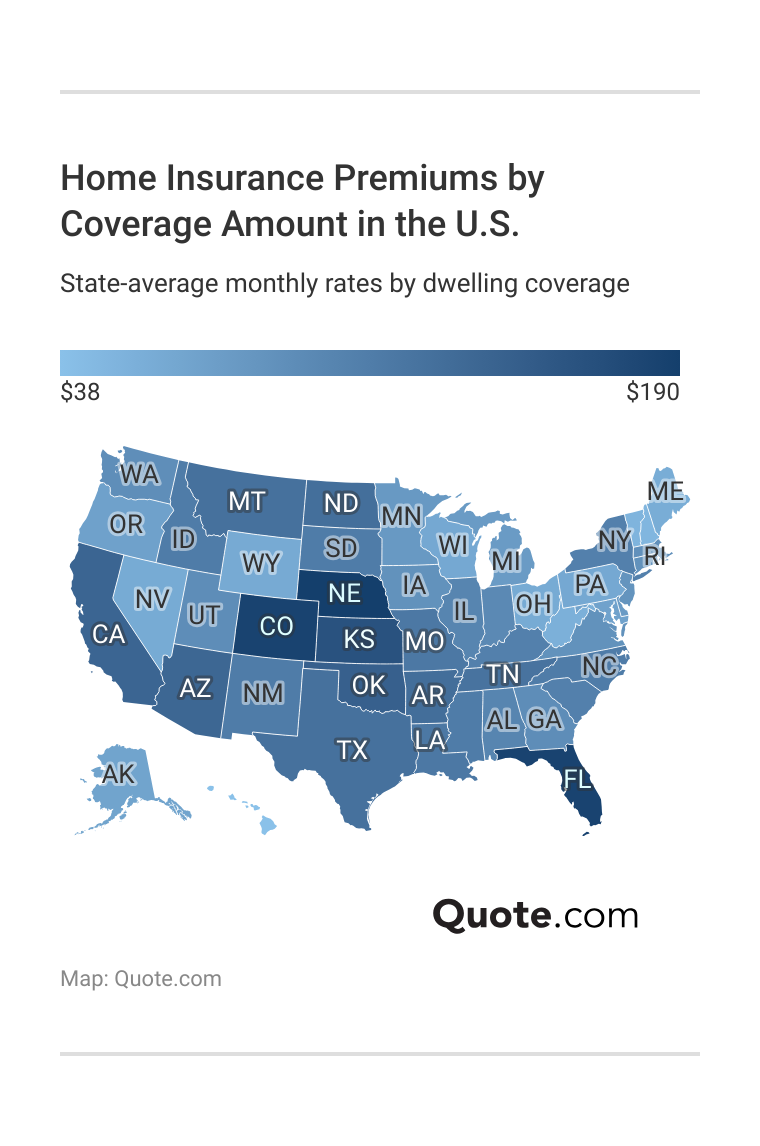

As we’ve mentioned, there are no homeowners insurance requirements by state, but your location still has an impact on home insurance rates.

When you compare homeowners insurance quotes based on where you live, you will see that some states have much more expensive rates than others.

The wide variance in cost between states is due to several factors, such as the cost of living, geographical weather patterns, claim numbers, and more. For example, Nebraska has the most expensive average U.S. premium for a $300k dwelling coverage at $471 per month, while Hawaii has an estimated $96 per month premium.

To find affordable home insurance for your dwelling in an expensive state, we recommend comparing quotes from at least a few companies in your area to find the best deal.

Choosing the Best Insurance Coverage for Your Home

The types of coverage you need for your home depend on your budget and how much you want to spend on home insurance (Learn More: How much homeowners insurance do you need?).

There are several types of insurance that may be beneficial to have on your home, from general dwelling coverage to additional living expenses (ALE).

Types of Home Insurance Coverage| Coverage | What it Covers | Example |

|---|---|---|

| Liability Protection | Accidents on your property | A guest falls and sues you |

| Medical Payments Coverage | Medical bills for guest injuries | Guest needs treatment after injury |

| Personal Property Coverage | Belongings inside the home | Theft of electronics or clothing |

| Dwelling Coverage | Structure of the home | Fire or storm damages house |

| Additional Living Expenses (ALE) | Temporary living costs | Hotel stay after fire damage |

Dwelling insurance is a basic part of home insurance policies, and covers the structure of your home. This means that if structures like the walls or roof are damaged, insurance will help cover repair costs.

In addition to basic dwelling home insurance, one recommended home insurance coverage is liability coverage for homeowners.

Liability insurance coverage protects you if someone is injured on your property or if property damage occurs to their items (Learn More: Understanding the 8 Types of Homeowners Insurance Policies).

Having liability insurance on your home insurance policy is therefore very important, as it helps protect you if you are sued by someone.

Liability home insurance will help protect you in several cases, such as if your dog bites someone or if someone trips down your steps.

Daniel Walker Licensed Insurance Agent

Another popular home insurance coverage is personal property insurance. This coverage can be for renters or homeowners.

Personal property insurance helps provide financial protection for what is inside your home, such as electronics, from theft, vandalism, and other incidents that damage your property or result in loss.

Adding personal property insurance to your home insurance policy ensures that both your home and your belongings are protected.

Ready to find a house insurance policy to protect your belongings and home today? Compare quotes with our free tool today to find the best policy that meets your home insurance needs.

Frequently Asked Questions

Is it mandatory to have home insurance in the U.S.?

No, the United States does not have homeowners insurance laws dictating coverage levels or minimum homeowners insurance requirements for a mortgage. No states require home insurance. You can choose not to have home insurance if you don’t have a mortgage, but it does leave you financially vulnerable.

What happens if you have a mortgage and no homeowners insurance?

If you have a mortgage but no home insurance, your lender may purchase insurance that meets the home insurance requirements for mortgages and force you to pay for it, or foreclose on your home. To find home insurance that protects you today, compare rates with our free tool.

What are the minimum homeowners insurance requirements?

There are no set requirements for home insurance that are universal. Lenders, HOAs, and landlords will all have their own requirements for how much home or renters insurance you need to have (Learn More: Best Renters Insurance Companies).

Is it okay not to have home insurance?

Wondering can I opt out of homeowners insurance? Although you may not need home insurance if you own your home outright, it is not advisable to do so. You don’t need homeowners insurance, but not having home insurance on your home is financially risky and leaves you at-risk for expensive repairs.

What percentage of people don’t have house insurance?

According to Census Bureau data, about 13% of Americans do not have home insurance on their homes. Worried about is it illegal to have a house without insurance? It is not illegal to have a home without home insurance.

However, if you have a mortgage, your lender may buy expensive insurance on your behalf and charge you for it, so it is best to get coverage on your own (Read More: Homeowners Insurance Coverage Explained).

How much is homeowners insurance on a $400,000 house?

Home insurance rates for a $400,000 policy will cost between $100 and $300 per month, depending on where you live and which company you choose. Enter your ZIP code to start comparing homeowners insurance quotes for free.

Is home insurance tax deductible?

In most cases, you can’t deduct house insurance from your taxes. However, if the home you own is a rental property, then you may be able to deduct insurance as a business expense.

Should I drop homeowners insurance?

It is not recommended to drop home insurance, as it leaves you financially vulnerable. If you need help finding reputable home insurance providers, check out our guide to the best homeowners insurance companies.

What are the alternatives to homeowners insurance?

If you are struggling to find insurance in high-risk areas, such as California, FAIR plans may be an option. Another option is to make sure you have plenty of funds set aside to pay for your home and belongings, but this isn’t practical or feasible for the majority of homeowners.

Do I need homeowners insurance if my house is paid for?

If your house is paid for and you no longer have a mortgage, you don’t need to carry home insurance unless required to by an HOA.

How much is homeowners insurance on a $200,000 house?

How does my credit score impact home insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.