Post

Post10 Cheapest Life Insurance Companies in 2026

If you’re looking for the cheapest life insurance companies, Liberty Mutual, AAA, and Nationwide stand out with rates starting around $24 per month. Liberty Mutual......

Secured with SHA-256 Encryption

Post

PostIf you’re looking for the cheapest life insurance companies, Liberty Mutual, AAA, and Nationwide stand out with rates starting around $24 per month. Liberty Mutual......

Post

PostThe top providers for the best instant life insurance are State Farm, Mutual of Omaha, and Erie, because of their proven strength in fast approvals......

Post

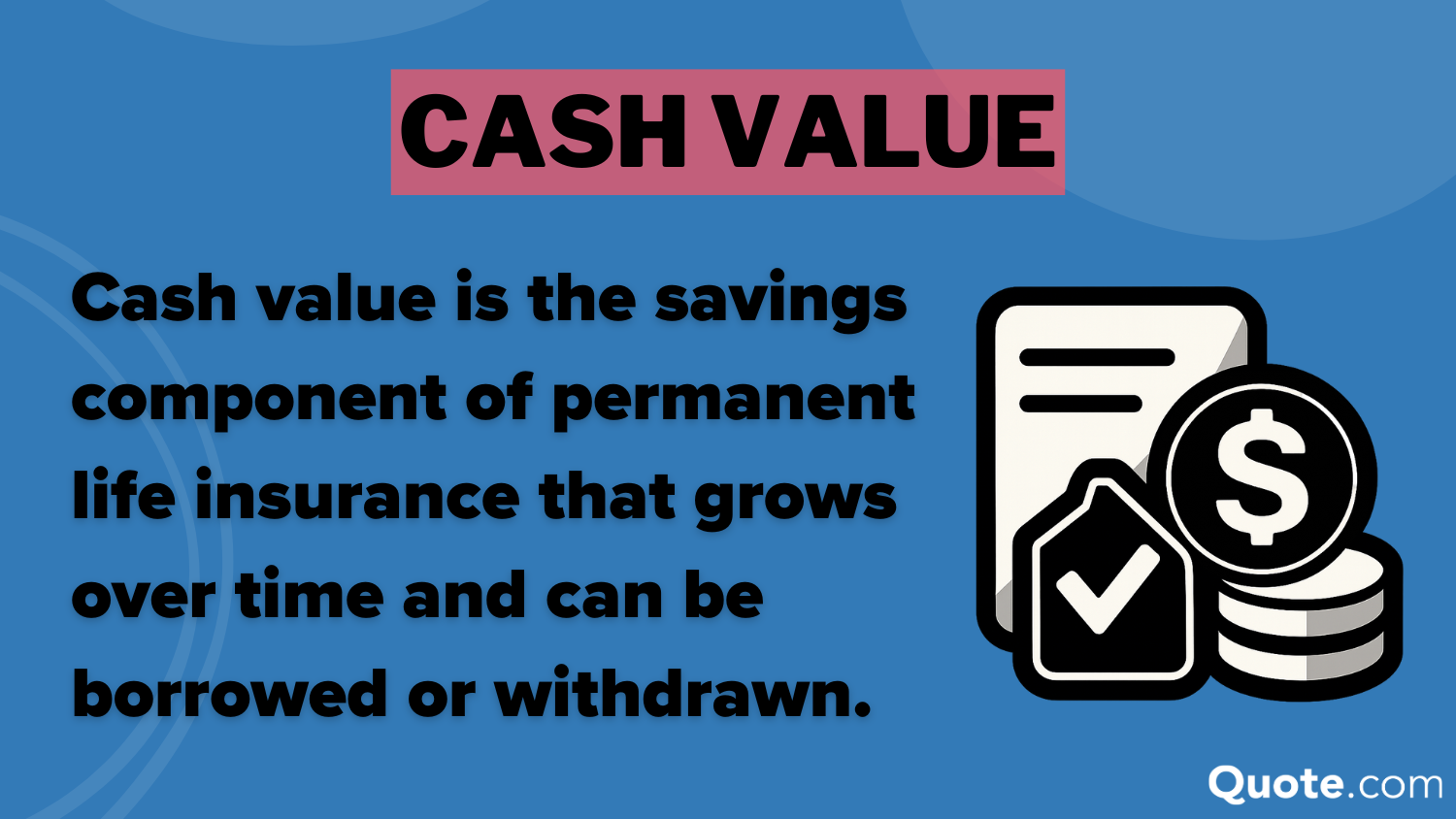

PostCash value life insurance offers permanent coverage with a built-in savings account that grows through interest or investments, making it a powerful financial planning tool.......

Post

PostWhole life insurance is permanent coverage that lasts a lifetime as long as premiums are paid, ensuring a guaranteed payout to beneficiaries. It differs from......

Post

PostThe cheapest million-dollar life insurance policies start at just $25 per month, with Pacific Life, Erie, and Mutual of Omaha leading the way for affordable......

Post

PostThere are several factors to consider when deciding how much life insurance you need, including your annual income, unpaid debts, and the number of dependents......

Post

PostThe main types of life insurance are term, whole, universal, variable, variable universal, final expense, and group insurance. Term life is most popular for affordability,......

Post

PostThe reasons to buy life insurance often come down to protecting your family, covering expenses, and building long-term financial security. Life insurance ensures that loved......

Post

PostTerm life insurance provides simple, affordable financial protection during your family’s most critical years. Policies typically last 15-30 years, offering flexibility for different life stages......

Post

PostThe average cost of life insurance varies depending on the policy type, age, health, and more. A 20-year term life insurance policy may start as......

Post

PostHow you get life insurance quotes begins with assessing your coverage needs, such as replacing income or paying debts. You should then compare the best......

Post

PostUniversal life insurance is a type of permanent life insurance that offers flexible premium payments, adjustable death benefits, and a cash value component that grows......

Post

PostSingle premium life insurance is a type of permanent life insurance that is paid for in one lump sum. Instead of making ongoing monthly or......

Post

PostPermanent life insurance is a type of life insurance that provides coverage for your entire life, as long as you continue to pay the required......

Post

PostA life insurance beneficiary is the person or entity you designate to receive your policy’s death benefit when you pass away. Choosing a beneficiary is......

Post

PostA Modified Endowment Contract (MEC) is a life insurance policy that fails the IRS’s 7-pay test, resulting in different tax treatment compared to standard life......

Post

PostA life insurance annuity is a financial product that provides a steady stream of income—often for life—based on premiums or lump sums paid to an......

Post

PostBefore buying a policy, you should know the differences between whole vs. term life insurance. Term life insurance costs less and covers short-term debts. Permanent......

Post

PostThere's no "right" time to start thinking about life insurance. Instead, our own experiences will let us determine that for ourselves....

Post

PostLife insurance can be complicated to understand. Make it easier by learning about tips for lowering your premiums, choosing a plan, and comparing the best companies out there....

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption