Post

Post10 Best Auto Insurance Companies in New York for 2026

The best auto insurance companies in New York are Geico, Allstate, and Liberty Mutual. Geico ranks first with budget-friendly rates starting at $51 per month,......

Secured with SHA-256 Encryption

Post

PostThe best auto insurance companies in New York are Geico, Allstate, and Liberty Mutual. Geico ranks first with budget-friendly rates starting at $51 per month,......

Post

PostThe top three best auto insurance companies in Washington are American Family, Allstate, and Progressive. American Family takes the top spot with accident forgiveness, a......

Post

PostThe best auto insurance companies in Arizona are Nationwide, Liberty Mutual, and State Farm, for handling high crash rates and costly hail damage across cities......

Post

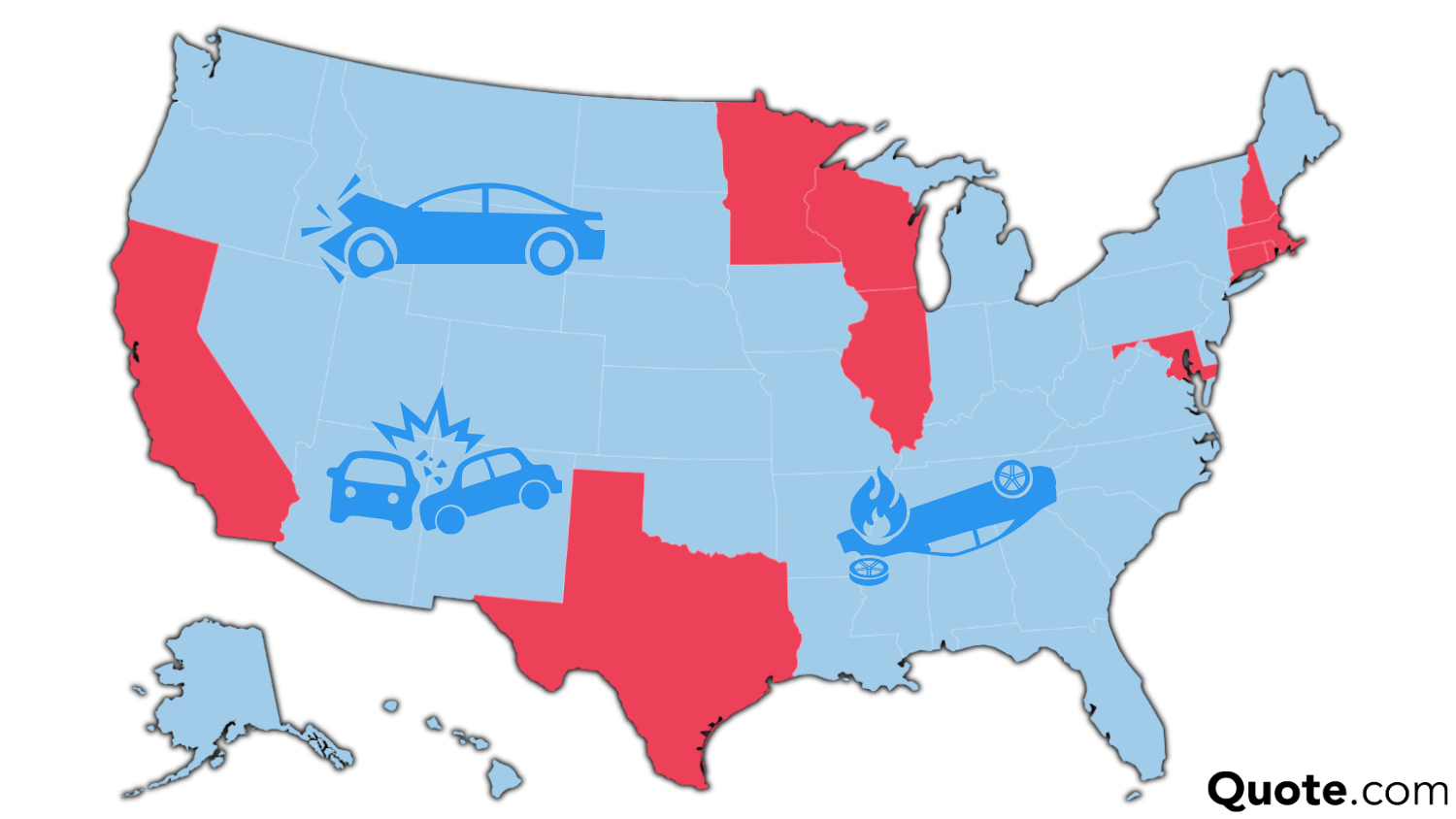

PostNavigating your auto insurance policy can be treacherous enough as it is. Depending on where you live, it can be even worse. How does your state compare?...

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption