Cheap Gap Insurance in 2026

Progressive provides cheap gap insurance at just $7 per month with easy online policy management. Gap coverage protects you from paying off an auto loan after a total loss. Drivers can lower auto insurance costs with stand-alone gap insurance, higher deductibles, and by maintaining strong credit.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated September 2025

Progressive, Auto-Owners, and Nationwide are the top picks for cheap gap insurance. Progressive comes first at $7 a month, Auto-Owners at $9 monthly with fast claims, and Nationwide at $10 a month with an A+ financial rating.

8 Best Companies: Cheapest Gap Insurance| Company | Rank | Monthly Rates | Car Age Limit | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $7 | 1 Year | Affordable Rates | Progressive | |

| #2 | $9 | 2 Years | Claims Efficiency | Auto-Owners | |

| #3 | $10 | 3 Years | Financial Strength | Nationwide |

| #4 | $11 | 2 Years | Customer Satisfaction | American Family |

| #5 | $17 | 2 Years | Nationwide Reach | Allstate | |

| #6 | $18 | 1 Year | Digital Tools | Liberty Mutual |

| #7 | $19 | 3 Years | Competitive Pricing | Erie |

| #8 | $22 | 2 Years | Flexible Coverage | Farmers |

This article explains how gap insurance works and the difference between your car’s actual cash value and loan balance if it’s totaled or stolen, so you don’t get stuck with thousands of dollars in debt (Read More: Expert Guide to Different Loans).

- Drivers can get gap insurance for just $7 per month from Progressive

- Auto-Owners offers some of the fastest total loss payouts

- Nationwide offers gap coverage on vehicles up to three years old

Compare gap vs. full coverage costs and know how budget-friendly options like Progressive and Auto-Owners keep premiums low. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

What is Gap Insurance & Why It Matters

Gap insurance (Guaranteed Asset Protection) covers the “gap” between your car’s actual cash value (ACV) and the amount you still owe if your vehicle is totaled or stolen. Standard auto insurance only pays the ACV, which can leave you thousands of dollars short on your loan or lease payoff.

Gap insurance is essential if you have a new car with a small down payment or a lease, as it protects you from owing thousands if your vehicle is totaled. Here are the key situations where gap insurance makes the most sense for drivers. You should consider gap insurance if:

- You purchased a new car with a small down payment and a long loan term.

- You’re leasing a car (often required by the lease contract).

- Your car model depreciates faster than average, creating negative equity risk.

- You want peace of mind that a total loss won’t leave you with a big, unpaid balance.

If any of these scenarios sound familiar, adding gap coverage to your auto policy can save you from significant out-of-pocket expenses and provide peace of mind during a total loss. Understanding how gap insurance works and what gap insurance covers helps you decide if it’s worth adding to your policy.

How Gap Insurance Works| Feature | Details | Example |

|---|---|---|

| Covers | Pays the difference between loan balance and car’s value if totaled or stolen | Loan: $25k, Value: $20k → GAP pays $5k |

| Doesn’t Cover | Repairs, maintenance, deductibles, late fees | If repairable, GAP doesn’t apply |

| Who Needs It | Low down payment, long loan, lease, or fast-depreciating car | $35k car, $500 down → risk of being upside down |

| When It Pays | Only if total loss and insurance payout < loan balance | Insurance: $18k, Loan: $23k → GAP: $5k |

| Cost | $20–$40/year (insurance) or $300–$700 (dealer) | May add interest if rolled into loan |

| Ends | When loan balance ≤ car’s value | Cancel once loan is lower than ACV |

Use this table to quickly gauge if you’re at risk of being “upside down” on your loan or auto lease. If so, gap coverage is a cost-effective way to avoid financial strain if your new vehicle is declared a total loss after a claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Gap Insurance Works

Gap insurance steps in when your car is totaled or stolen and your insurance payout isn’t enough to cover your remaining loan or lease balance. This is especially helpful for drivers with new cars or small down payments, where depreciation happens quickly and creates a large financial gap. Learn how to lease a car when you can’t afford to buy one.

Gap insurance is essential for new car financing with small down payments. Standard auto insurance only pays actual cash value, leaving gaps of $5,000-$8,000 easily.

Rachael Brennan Licensed Insurance Agent

Let’s say you bought a new car for $25,000 with a $5,000 down payment, financing $20,000. Six months later, your car is totaled in an accident. Because cars lose value quickly, your insurance payout may not cover what you still owe, leaving you with a large balance. Without gap insurance, you would face the following situation:

- You still owe: $20,000 on your loan.

- Insurance pays: $16,000 (current market value after depreciation).

- You’re stuck paying: $4,000 out-of-pocket for a car you no longer have.

Instead of being left with a bill for thousands of dollars, gap coverage pays the difference, so you can walk away without extra debt. This added protection ensures you don’t drain your savings or take out another loan to cover the remaining balance. Here’s what happens with gap insurance in place:

- You still owe: $20,000 on your loan.

- Insurance pays: $16,000 (current market value).

- Gap insurance covers: $4,000 difference (minus any deductible).

- You pay: $0 additional out-of-pocket.

Gap coverage automatically activates when your car is totaled and pays the difference directly to your lender within 30 days. This protection keeps you from making payments on a vehicle that no longer exists and helps you get back on the road faster.

Gap Insurance Costs vs. Full Coverage

Gap coverage is typically much cheaper than full coverage, making it a smart choice for drivers who risk owing more than their car is worth. When added to an auto policy, gap insurance usually costs $20–$40 per year, while dealerships often charge a one-time $400–$700 fee that may be rolled into your loan with interest.

Gap vs. Full Coverage Auto Insurance Monthly Rates| Insurance Company | Gap Coverage | Full Coverage |

|---|---|---|

| $17 | $228 | |

| $11 | $166 |

| $9 | $124 | |

| $19 | $83 |

| $22 | $198 | |

| $18 | $248 |

| $10 | $164 |

| $7 | $165 |

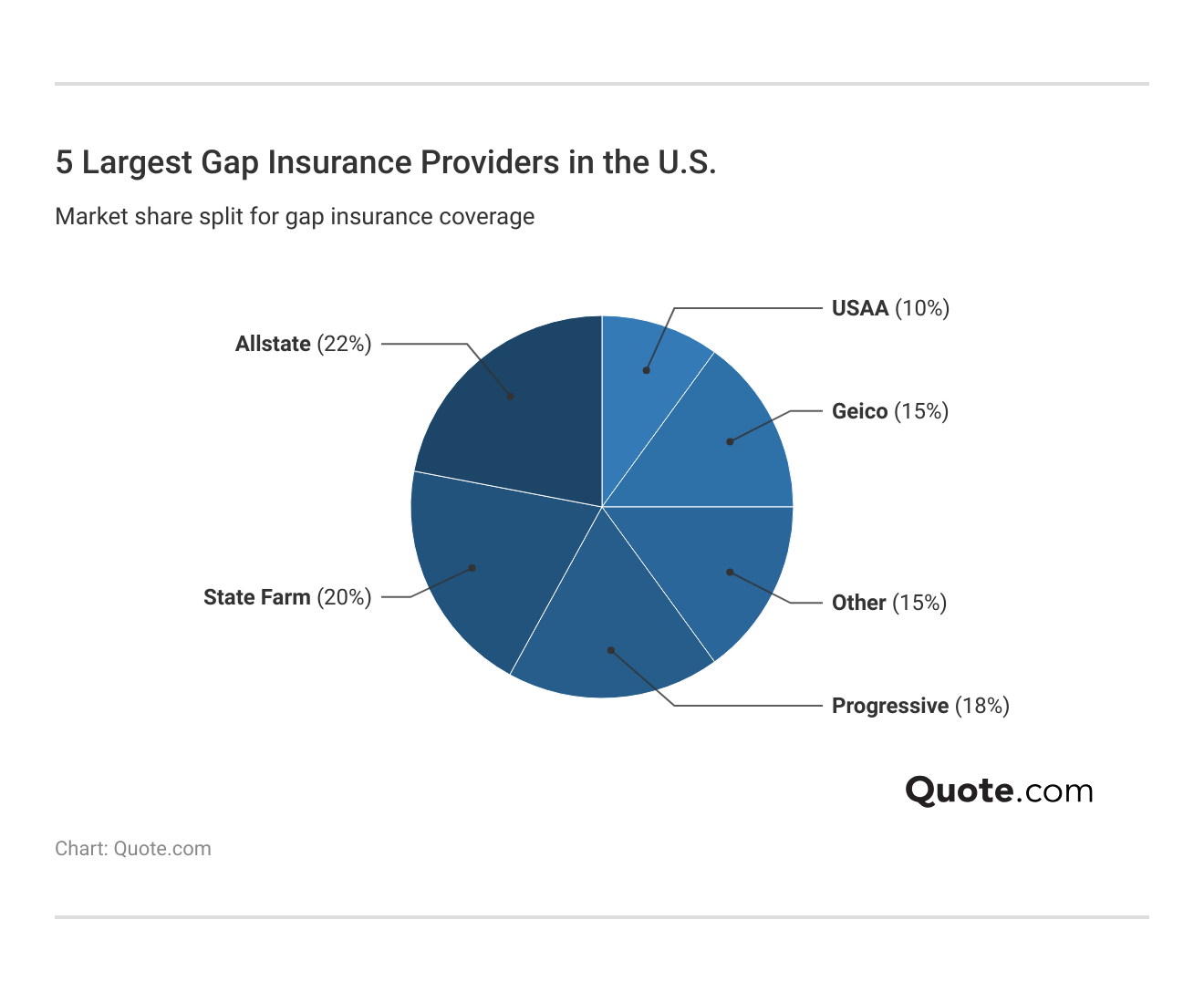

As you can see, Progressive leads with $7 monthly rates, while Farmers is the priciest at $22. Comparing these rates helps you find the best balance between protection and affordability for your situation. Knowing which companies dominate the gap insurance market can help you choose a reliable provider.

Allstate holds the largest share at 22%, closely followed by State Farm at 20% and Progressive at 18%. Choosing a leading provider can give you confidence in claims reliability and financial stability, but don’t rule out local or regional providers that may offer better rates.

Read More: Comprehensive Auto Insurance

Lowering the Cost of Gap Insurance

Maximizing discounts and smart strategies can significantly lower the cost of gap insurance, especially for new cars. Start by comparing quotes from multiple insurers and look for stand-alone gap insurance, which can cost less than dealer add-ons.

Choosing a higher deductible on your auto policy and maintaining a good credit score can also lower premiums. Finally, consider bundling home and auto policies for additional savings. Ask for all available discounts from your provider to see what additional savings you qualify for.

Top Auto Insurance Discounts by Provider| Insurance Company | Accident Free | Bundling | Low Mileage | Loyalty | Safe Driver |

|---|---|---|---|---|---|

| 25% | 25% | 30% | 15% | 18% | |

| 25% | 25% | 20% | 18% | 18% |

| 16% | 16% | 30% | 10% | 8% | |

| 25% | 25% | 30% | 10% | 15% |

| 20% | 20% | 10% | 12% | 20% | |

| 20% | 25% | 30% | 10% | 20% |

| 20% | 20% | 40% | 8% | 12% |

| 10% | 10% | 30% | 13% | 10% |

Nationwide offers the highest low-mileage discount at 40%, while Allstate, American Family, and Erie lead with 25% bundling savings. Using these discounts can make it easier to stay protected with gap coverage without overspending.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Cheap Companies for Gap Insurance

Progressive, Auto-Owners, and Nationwide are the cheapest gap insurance companies, with rates under $10 per month. While no separate gap insurance program exists, these top insurers offer the cheapest options to protect drivers from paying out-of-pocket after a total loss.

#1 – Progressive: Top Overall Pick

Pros

- Lowest Monthly Cost: At $7 a month, Progressive gap insurance is the best choice for budget-conscious drivers. See more quotes in our Progressive auto insurance review.

- Easy Online Access: The Progressive app allows drivers to manage policies, file claims, and make changes quickly from any device.

- Flexible Add-Ons: Gap coverage can be added to existing Progressive auto policies.

Cons

- One-Year Limit: Coverage is only available for vehicles in their first year, leaving out drivers with slightly older cars.

- Average Service: Customer service ratings are moderate compared to competitors that rely on agent-focused, personalized support.

#2 – Auto-Owners: Best for Claims Efficiency

Pros

- Quick Claims Payouts: Auto-Owners is highly rated for efficient, fair settlements after a total loss. Our Auto-Owners auto insurance review highlights its strong claims process.

- Local Agent Support: Drivers receive one-on-one service from knowledgeable agents who can assist with coverage and claims guidance.

- Broad Add-Ons: Additional coverage options like rental reimbursement and roadside assistance pair well with gap insurance.

Cons

- Limited Availability: Auto-Owners operates in select states only, so many drivers won’t have access to its gap coverage.

- Fewer Digital Tools: The company offers limited online and mobile account management features compared to national carriers.

#3 – Nationwide: Best for Financial Strength

Pros

- Stable Coverage: A+ A.M. Best rated, Nationwide pays claims, and is financially strong. Our Nationwide auto insurance review explains why.

- Three-Year Limit: Coverage extends to vehicles up to three years old, giving drivers a wider eligibility window than many competitors.

- Bundling Discounts: Bundle auto and gap with home policies for big savings.

Cons

- Mid-Tier Price: At $10 a month, it’s higher than Progressive and Auto-Owners if you’re on a tight budget.

- Basic Digital Tools: Website and app functionality are less streamlined compared to tech-forward competitors.

#4 – American Family: Best for Customer Satisfaction

Pros

- Positive Service Reputation: American Family is known for high satisfaction scores in claims handling and customer support. Our AmFam Insurance review explores why policyholders rate it highly.

- Easy Bundling: Gap coverage can be combined with renters or home policies to build comprehensive protection at a discount.

- Good Discounts: Drivers can save with safe driver and multi-policy programs to reduce overall premium costs.

Cons

- Higher Price: At $11 per month, it costs more than lower-priced competitors like Progressive.

- State Limitations: Not available in all states.

#5 – Allstate: Best for Nationwide Reach

Pros

- Extensive Availability: Allstate is available in almost every state. This Allstate auto insurance review compares its national coverage.

- Local Agent Network: Thousands of agents across the country offer in-person support for claims and coverage questions.

- Extra Features: Add-ons like accident forgiveness can be bundled with gap coverage to improve protection.

Cons

- Higher Cost: $17 per month makes Allstate far more expensive than budget-friendly competitors like Progressive.

- Mixed Service Quality: Customer service varies by region, so experiences are inconsistent.

#6 – Liberty Mutual: Best for Digital Tools

Pros

- Tech-Friendly App: Liberty Mutual offers one of the best apps for managing policies, filing claims, and accessing digital ID cards. Our Liberty Mutual Insurance review explains why tech users prefer it.

- Convenient Add-On: Gap coverage can be added seamlessly when purchasing or renewing an auto policy.

- Discount Programs: Safe-driver and low-mileage discounts can help offset Liberty Mutual’s higher pricing.

Cons

- Pricey Option: At $18 per month, Liberty Mutual is one of the most expensive providers of gap insurance.

- Strict Limit: Only applies to first-year cars, not older vehicles.

#7 – Erie: Best for Competitive Pricing

Pros

- Strong Local Service: Erie’s local agents provide personal, community-based support for drivers who value face-to-face service. This Erie auto insurance review highlights its agent network.

- Three-Year Window: Offers gap coverage for vehicles up to three years old, giving more flexibility than one-year policies.

- Bundling Opportunities: Big savings when gap coverage is bundled with home or auto.

Cons

- Limited Reach: Only available in certain states, so not all drivers are eligible.

- Weaker Digital Experience: Lacks a robust mobile app for 24/7 claims service.

#8 – Farmers: Best for Flexible Coverage

Pros

- Customizable Plans: Farmers offers multiple endorsements so drivers can build policies that fit unique needs. This Farmers auto insurance review highlights its flexibility.

- Rideshare Coverage: One of the few carriers that offer specific coverage for Uber and Lyft drivers.

- Agent Assistance: Local agents help policyholders create comprehensive plans tailored to their circumstances.

Cons

- Highest Price: Farmers is the most expensive gap coverage provider on this list, at $22 per month.

- Availability Limits: Some policy options and endorsements are not offered in every state.

Picking the Right Gap Insurance Provider

Progressive, Auto-Owners, and Nationwide are the best providers for cheap gap insurance. Progressive leads with the lowest monthly cost at $7, Auto-Owners delivers exceptionally fast claims payouts, and Nationwide provides coverage for vehicles up to three years old with an A+ financial rating.

Remember that there is no Geico or State Farm gap insurance. Finding the right gap insurance provider requires you to know how to get multiple auto insurance quotes and more. Consider these key factors when shopping around to generate the most accurate gap insurance quotes possible:

- Check Vehicle Age Limits: Progressive only covers first-year cars, while Nationwide extends to three years.

- Review Your State’s Availability: Auto-Owners and Erie operate in limited states only.

- Calculate Bundling Discounts: Adding gap to existing auto policies often reduces overall premiums.

- Verify Claims Processing Speed: Fast payouts prevent extended loan payments on totaled vehicles.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool to instantly compare prices from various gap insurance companies near you.

Frequently Asked Questions

What is the best gap insurance?

Progressive offers the best gap insurance at $7 monthly with easy online management. Auto-Owners provides fast claims processing, while Nationwide covers vehicles up to three years old.

Read More: A Visual Guide to Auto Insurance (3-D Interactive)

How much does it cost to get gap insurance?

Gap insurance costs $7-$22 monthly through auto insurers or $20-$40 annually. Dealerships charge $400-$700 upfront, making auto carriers significantly cheaper for most drivers. Get fast and cheap auto insurance coverage today with our quote comparison tool.

What is better than gap insurance?

Nothing replaces gap insurance for loan protection. Making larger down payments reduces negative equity risk, but gap coverage remains the most cost-effective protection against depreciation.

Is it worth getting gap insurance?

Yes, gap insurance is worth it for financed vehicles with small down payments. At $7-$22 monthly, it prevents thousands in out-of-pocket costs if totaled.

What’s the most gap insurance will pay?

Gap insurance pays the difference between your loan balance and the car’s actual cash value, minus deductibles. There’s typically no maximum limit on coverage amounts.

What is the best company to get gap insurance?

Progressive is the best auto insurance company at $7 monthly. Auto-Owners excels in fast claims processing, while Nationwide offers three-year coverage with strong financial ratings.

How do I calculate if I need gap insurance?

Compare your loan balance to your car’s current market value online. If you owe more than the car’s worth, gap insurance protects against loss.

What is the waiting period for gap cover?

Most gap insurance has no waiting period. Coverage begins immediately when added to your auto policy, protecting you from the first day of activation.

What invalidates gap insurance?

Missed premium payments, policy cancellation, vehicle modifications, commercial use, or exceeding mileage limits can invalidate gap insurance coverage. Always maintain your primary auto insurance, too.

Does Geico offer gap insurance?

Yes, Geico gap insurance is available as an add-on for financed or leased vehicles. It covers the difference between your car’s actual cash value and loan payoff if your vehicle is totaled. This option is ideal for drivers with new cars and low down payments.

What is stand-alone gap insurance?

What happens if you use gap insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.