10 Best Auto Insurance Companies in Oklahoma for 2026

State Farm, American Family, and Allstate lead as the best auto insurance companies in Oklahoma. Car insurance quotes in Oklahoma start at $38 per month, but these top providers offset higher rates with accident forgiveness, strong A.M. Best ratings, and valuable safe-driver and bundling discounts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated September 2025

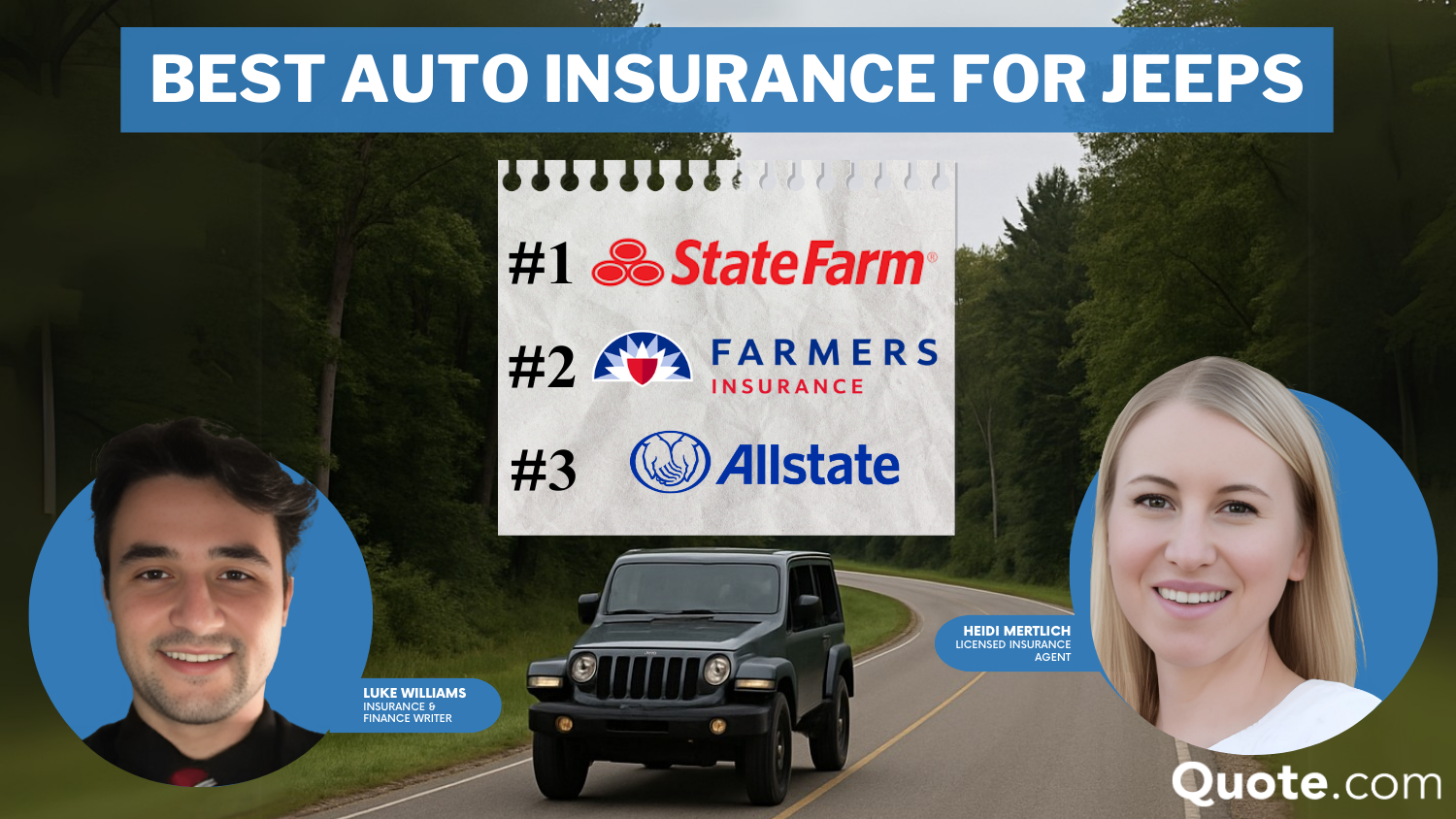

The best auto insurance companies in Oklahoma are State Farm, American Family, and Allstate. All three provide excellent customer service backed by strong financial strength.

- Top auto insurance companies in Oklahoma include rideshare driver coverage

- State Farm offers OK drivers roadside service and travel expense coverage

- Allstate car insurance in Oklahoma offers diminishing deductible benefits

State Farm is recognized for its accident forgiveness and Drive Safe & Save telematics program, which rewards low-mileage drivers. American Family provides notable bundling discounts and policy add-ons like gap insurance.

Allstate stands out with high A.M. Best ratings and pay-per-mile coverage, proving why it remains one of the best car insurance companies in Oklahoma.

Top 10 Companies: Best Auto Insurance in Oklahoma| Company | Rank | Claims Satisfaction | A.M. Best | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 664 / 1,000 | A++ | Local Agents | State Farm | |

| #2 | 660 / 1,000 | A | Customer Service | American Family |

| #3 | 644 / 1,000 | A+ | Milewise Program | Allstate | |

| #4 | 641 / 1,000 | A++ | Budget Rates | Geico | |

| #5 | 640 / 1,000 | A | Online Tools | Liberty Mutual |

| #6 | 637 / 1,000 | A+ | High-Risk Drivers | Progressive | |

| #7 | 632 / 1,000 | A+ | Usage Discounts | Nationwide | |

| #8 | 628 / 1,000 | A | Membership Perks | AAA |

| #9 | 597 / 1,000 | A | Bundling Options | Safeco | |

| #10 | 585 / 1,000 | A++ | Policy Flexibility | Travelers |

Save money with the cheapest auto insurance by comparing personalized car insurance quotes in Oklahoma instantly using our free online tool.

Comparing Auto Insurance Rates in Oklahoma

Oklahoma auto insurance monthly rates give a good picture of how the best car insurance companies approach coverage.

Progressive and State Farm stay affordable, offering programs like Snapshot and Drive Safe & Save that reward safe driving with usage-based savings.

Oklahoma Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $59 | $183 | |

| $52 | $160 |

| $49 | $148 | |

| $81 | $250 |

| $54 | $165 | |

| $48 | $149 | |

| $38 | $101 | |

| $40 | $123 | |

| $46 | $142 |

Safeco sits on the lower end, which makes it attractive for drivers trying to keep their bills down, but that usually means fewer extras built into the policy. Liberty Mutual costs more, but the price often reflects extra tools and coverage that some drivers find worth it.

American Family and Allstate can be a little higher on full coverage, but people stick around for solid service, local agents, and accident forgiveness.

Rates often change based on how you set your coverage. Specifically, higher liability limits raise costs but give stronger protection.

Michelle Robbins Licensed Insurance Agent

It pays to compare your car insurance price in Oklahoma across multiple providers before you buy to look at what those dollars buy you in service and protection.

For instance, Nationwide and Geico keep rates steady with strong financial backing and digital conveniences. American Family manages to combine reasonable costs with reliable claims service and a wide local agent network, which is why so many drivers stick with it.

How Age Impacts Oklahoma Insurance Rates

When you look at Oklahoma auto insurance monthly rates by age, you can see how much insurers connect price to risk. Teen drivers typically pay the most because they often lack experience and are more likely to be involved in accidents. That’s why auto insurance for teens is usually the most expensive.

Safe-driving programs and good student discounts can help young drivers ease the cost. Once drivers reach their mid-20s and 30s, premiums tend to drop as insurers recognize a proven record behind the wheel and reward years of safe driving with more affordable costs.

Oklahoma Auto Insurance Monthly Rates by Age| Insurance Company | Age: 16 | Age: 25 | Age: 35 | Age: 45 | Age: 55 | Age: 65 |

|---|---|---|---|---|---|---|

| $269 | $59 | $55 | $65 | $43 | $45 |

| $256 | $69 | $64 | $59 | $56 | $58 | |

| $244 | $65 | $61 | $52 | $49 | $52 |

| $174 | $45 | $41 | $49 | $46 | $47 | |

| $309 | $87 | $81 | $81 | $76 | $80 |

| $239 | $71 | $66 | $54 | $50 | $53 | |

| $438 | $73 | $68 | $48 | $48 | $54 | |

| $224 | $61 | $57 | $38 | $51 | $55 | |

| $155 | $50 | $42 | $40 | $38 | $39 | |

| $456 | $54 | $44 | $46 | $40 | $60 |

Older drivers typically pay less for Oklahoma auto insurance, but some companies may raise prices again by the mid-60s as age-related risks become more common.

The company offering the best value at 25 might not be the same one at 55, making it important to compare options when searching for the best car insurance in Oklahoma for seniors.

How Driving History Impacts Oklahoma Insurance Rates

If you maintain a clean record, you are typically rewarded with lower Oklahoma car insurance rates, as insurers view you as a lower risk.

When you get an accident, ticket, or DUI on your record, prices tend to climb since companies expect a higher chance of future claims.

Oklahoma Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $71 | $82 | $58 |

| $59 | $76 | $77 | $63 | |

| $52 | $79 | $87 | $61 |

| $49 | $80 | $83 | $64 | |

| $81 | $144 | $163 | $117 |

| $54 | $76 | $111 | $64 | |

| $48 | $118 | $58 | $68 | |

| $38 | $60 | $67 | $49 | |

| $40 | $45 | $42 | $42 | |

| $46 | $66 | $164 | $62 |

For drivers across Oklahoma, even a single mistake can affect rates for years. A minor ticket may only raise costs slightly, but a DUI often results in steep increases due to its connection to expensive claims.

Some insurers are more stringent, while others offer drivers a bit of leeway. Using an auto insurance guide can make it easier to understand these patterns and find not just a cheap plan, but one that feels fair for your record.

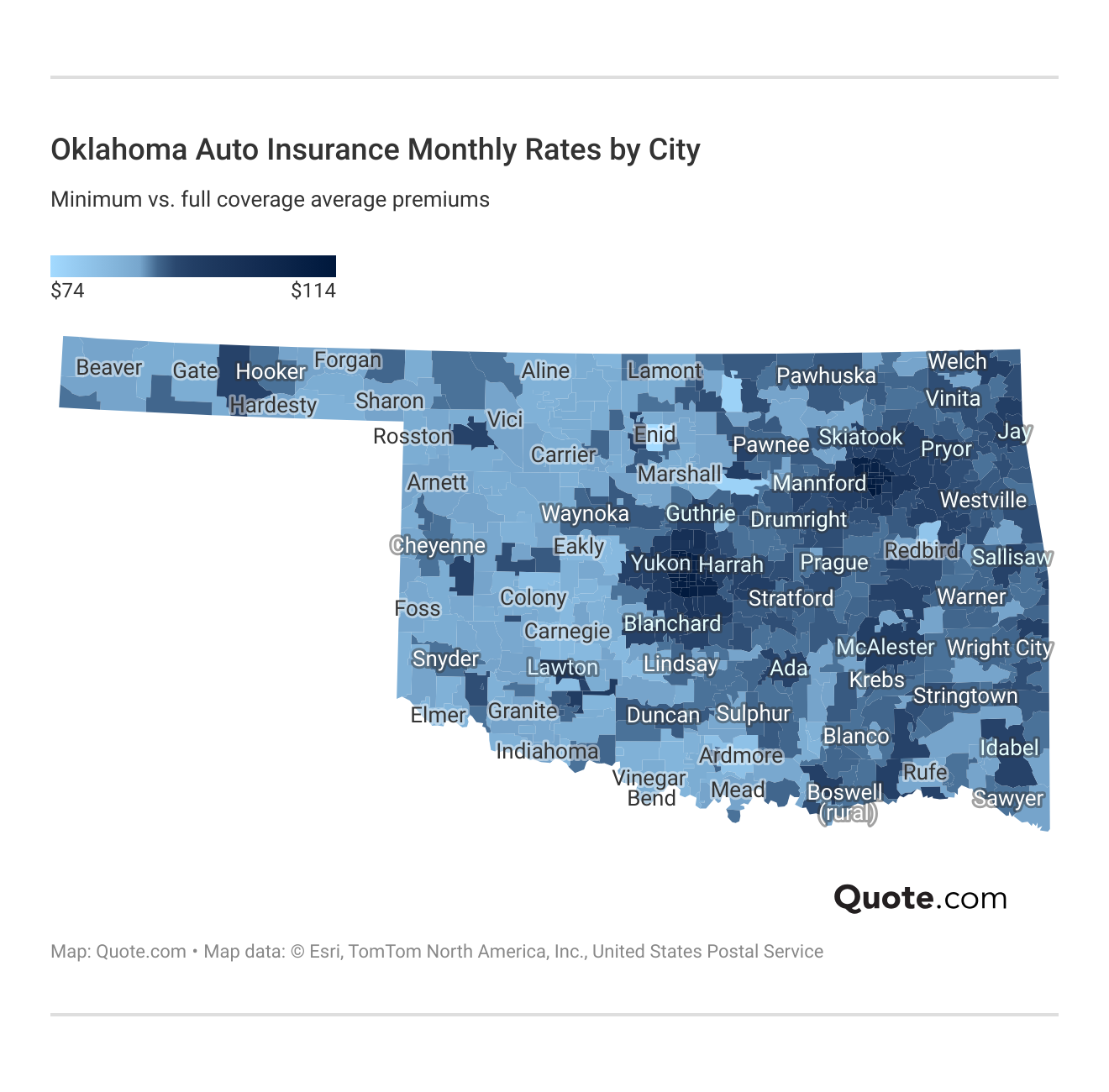

How Location Impacts Oklahoma Insurance Rates

In larger cities, Oklahoma auto insurance rates often climb because more traffic means more accidents, along with higher risks of theft and costly comprehensive auto insurance repairs. Smaller towns usually see fewer claims, which helps keep premiums low.

These differences illustrate why two individuals with similar driving records can pay significantly different amounts, solely based on their location, and why coverage often costs more in higher-risk areas.

For people across Oklahoma, your ZIP code can matter just as much as your driving record. Living in a busy area may mean budgeting more for insurance, while rural drivers often benefit from lower costs thanks to reduced risk.

Comparing quotes by city is one of the easiest ways to understand the auto insurance price in Oklahoma and see if comprehensive auto insurance is worth the added protection where you live.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Oklahoma

In Oklahoma, you’re required to carry a basic amount of auto insurance to legally drive, but those limits only go so far if you’re in a serious accident. They’re designed to give you a safety net, not to cover every possible cost.

These minimums keep you street-legal, but they may not give you enough protection when things really go wrong.

- Bodily Injury per Person: At least $25,000 to cover one person’s injuries.

- Bodily Injury per Accident: At least $50,000 total if several people are hurt.

- Property Damage per Accident: At least $25,000 to fix or replace someone else’s car or property.

That’s why most Oklahoma auto insurance companies recommend higher limits or adding extra coverage beyond the basics so you’re not left paying the difference yourself.

Collision auto insurance is especially useful for cars under ten years old since it helps pay for repairs or replacement after an accident, and the best car insurance companies in Oklahoma let you adjust deductibles to keep monthly costs manageable.

Comprehensive coverage is just as important here, where hail, tornadoes, and flooding can do real damage, and companies often include helpful add-ons like glass repair or theft protection.

With nearly 14% of drivers in Oklahoma uninsured, having uninsured motorist coverage is another smart way to protect yourself from paying for someone else’s mistake.

On top of that, extras like $50 roadside assistance, $900 rental reimbursement, and medical payments coverage give drivers more peace of mind by adding real support when unexpected problems come up.

Fast Ways to Save on Auto Insurance in Oklahoma

Oklahoma drivers quickly learn that discounts can make or break the affordability of their car insurance. The best insurance discounts reward real habits, such as driving less, maintaining a clean record, or bundling policies together.

For example, a safe driver discount can reduce costs by as much as 20%, giving careful drivers a noticeable break and helping them save money on auto insurance in the long run.

Top Auto Insurance Discounts in Oklahoma| Insurance Company | Bundling | Defensive Driving | Good Driver | Low Mileage | Usage- Based |

|---|---|---|---|---|---|

| 15% | 14% | 30% | 10% | 30% |

| 25% | 10% | 25% | 30% | 30% | |

| 25% | 5% | 25% | 20% | 20% |

| 25% | 15% | 26% | 30% | 25% | |

| 25% | 10% | 20% | 30% | 30% |

| 20% | 10% | 40% | 40% | 25% | |

| 10% | 30% | 30% | 30% | $231/yr | |

| 15% | 10% | 20% | 25% | 30% | |

| 17% | 15% | 25% | 30% | 30% | |

| 13% | 20% | 10% | 20% | 30% |

Different discounts also highlight how companies try to connect with different drivers. Families often reap the most benefits from bundling, while cautious drivers enjoy rewards for safe driving habits.

Pay-as-you-go car insurance is also becoming increasingly popular, as it allows individuals to pay based on their driving habits, including the frequency and safety of their driving.

Some programs even use telematics to track mileage and driving patterns, which can turn into real savings for low-mileage drivers across the state.

With the best auto insurance companies in Oklahoma, it’s easy to think discounts are the only way to save. But there are other smart moves drivers can make that have just as much impact on what they pay month to month.

- Work on Your Credit Score: Insurers in Oklahoma factor this in, and improving your score can bring your premiums down over time.

- Raise Your Deductible: Switching from $500 to $1,000 could trim 10–15% off your monthly bill if you’re ready for a higher out-of-pocket cost.

- Cut Coverage You Don’t Need: If your car is older and worth less than $4,000, dropping collision or comprehensive coverage might save you hundreds a year.

- Pay Upfront: Covering six or twelve months at once usually avoids fees and can unlock small but steady savings.

- Update After Life Changes: If you let your insurer know, marriage, moving, or even a new job could make you eligible for lower rates.

At the end of the day, saving on car insurance isn’t just about discounts. Combining these strategies with car insurance discounts you can’t miss gives Oklahoma drivers more control over the auto insurance price while keeping the right coverage in place.

Top Auto Insurance Companies in Oklahoma

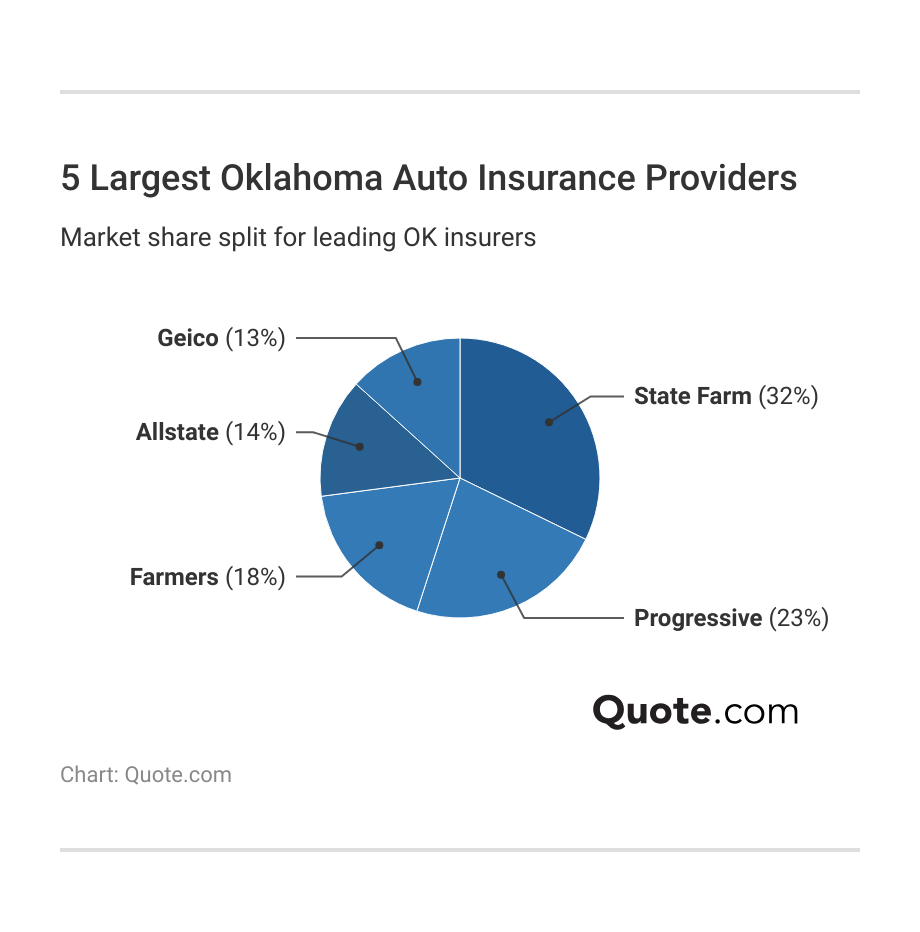

The best auto insurance companies in Oklahoma show what drivers really value beyond market share. State Farm’s lead makes it clear that many still trust local agents and long-term stability.

Allstate shows how much drivers like using digital tools and getting rewarded for safe driving, while Geico proves that affordable rates and simple online service are still hard to beat.

Progressive’s growth reflects the interest in programs that track driving and reward safer habits. Farmers connects with families who want the ease of bundling their coverage and saving money along the way.

For drivers, it proves the car insurance price in Oklahoma matters, but so does finding a provider that matches your needs and the types of auto insurance that fit your lifestyle.

#1 – State Farm: Best for Local Agents

Pros

- Local Network Strength: State Farm has one of the largest agent networks in Oklahoma, making it easy for drivers to get face-to-face help when they need it.

- Strong Claims Service: With a 664 out of 1,000 claims satisfaction score, State Farm shows steady performance for Oklahoma customers.

- Financial Security: An A++ A.M. Best rating assures Oklahoma drivers of unmatched claims-paying stability. Read our State Farm auto insurance review for coverage options.

Cons

- Limited Discount Variety: While State Farm offers safe-driver and multi-policy savings, Oklahoma customers have fewer niche options, like vanishing deductible or hybrid car discounts.

- Limited Digital Claims: Oklahoma drivers cannot submit real-time photo estimates like Geico app users.

#2 – American Family: Best for Customer Service

Pros

- Superior Service: American Family ranks above Allstate and many other Oklahoma insurers for claim satisfaction. Get more ratings in our American Family Insurance review.

- Bundling Discounts: It’s one of the best home and auto insurance companies in Oklahoma, and policyholders can save up to 25% when bundling coverage.

- Gap Coverage: Oklahoma customers leasing or financing cars can protect loan balances with affordable optional gap insurance.

Cons

- Higher Costs: Full coverage premiums in Oklahoma start at $160 per month, higher than many Oklahoma car insurance companies on our list.

- Agent Limits: In rural Oklahoma, American Family’s agent footprint is smaller than State Farm’s.

#3 – Allstate: Best for Milewise Program

Pros

- Milewise Rewards: Oklahoma drivers using the pay-per-mile app can save up to 30% by driving less than 10,000 miles per year.

- Strong Stability: Allstate’s A+ A.M. Best rating gives Oklahoma drivers reliable claims confidence. Find policy options explained in our Allstate insurance review.

- New-Car Protection: Allstate offers Oklahoma customers new-car replacement, reimbursing for a new model after a total loss.

Cons

- Higher Deductibles: Many Allstate policies in Oklahoma come with standard deductibles that can be costly for drivers without optional deductible rewards.

- Premium Hikes: Oklahoma drivers who have accidents face sharp increases compared to Nationwide or Progressive.

#4 – Geico: Best for Budget Rates

Pros

- Budget-Friendly Coverage: Geico liability in Oklahoma averages around $49 per month, keeping costs low for price-conscious drivers.

- Digital Tools: Oklahoma drivers manage billing, claims, and ID cards entirely through Geico’s mobile app.

- Financial Backing: An A++ A.M. Best rating ensures Oklahoma drivers’ long-term payment security. Check our Geico insurance review for Oklahoma savings today.

Cons

- No Gap Insurance: Oklahoma policyholders lack add-ons like gap insurance, unlike American Family.

- Minimal Agents: Geico offers limited face-to-face support for Oklahoma customers outside major cities.

#5 – Liberty Mutual: Best for Online Tools

Pros

- Digital Efficiency: The Liberty Mutual app makes it easy for Oklahoma drivers to upload accident photos and follow their claims step by step.

- Strong Financial Rating: With an A from A.M. Best, Liberty Mutual gives Oklahoma customers confidence that their claims will be backed by a strong financial footing.

- Lots of Discounts: Oklahoma policyholders can lower their premiums with accident forgiveness, early-shopper savings, and multi-car discounts.

Cons

- Limited Add-On Options: Liberty Mutual in Oklahoma does not widely offer extras such as vanishing deductibles or hybrid vehicle discounts.

- Higher Premiums: Oklahoma full coverage averages $250 or more per month, pricier than Progressive or Geico. Explore our Liberty Mutual insurance review for rates and discounts.

#6 – Progressive: Best for High-Risk Drivers

Pros

- Nonstandard Coverage: Progressive insures Oklahoma drivers with DUIs, SR-22 filings, or multiple accidents, covering higher-risk groups.

- Snapshot Savings: Oklahoma drivers earn up to 30% off with safe Snapshot telematics performance. Compare premiums in our Progressive auto insurance review.

- Strong Financial Strength: Progressive’s A+ A.M. Best rating ensures Oklahoma claims reliability.

Cons

- Average Service: With a score of 637/1,000, Progressive ranks below most Oklahoma car insurance companies in claims satisfaction.

- Limited Local Support: Progressive operates primarily online in Oklahoma, which can leave some drivers without convenient access to in-person assistance.

#7 – Nationwide: Best for Usage-Based Discounts

Pros

- SmartRide Discounts: Oklahoma policyholders earn up to 40% off with usage-based monitoring. Learn how it works in our Nationwide auto insurance review.

- Deductible Advantage: Vanishing Deductible reduces Oklahoma deductibles by $100 annually for accident-free drivers.

- Accident Forgiveness: Oklahoma drivers can add accident forgiveness coverage, preventing premium increases after their first at-fault claim.

Cons

- Higher Full Coverage: Nationwide full coverage in Oklahoma starts at $165 monthly, higher than more affordable companies like State Farm.

- Rural Gaps: Fewer agent offices in rural Oklahoma reduce accessibility.

#8 – AAA: Best for Membership Perks

Pros

- Membership Benefits: AAA provides Oklahoma policyholders with travel, hotel, and retail discounts with membership.

- Roadside Help: 24/7 roadside assistance is bundled with auto insurance in Oklahoma. See how Oklahoma drivers benefit in the full AAA auto insurance review.

- Add-On Coverage: Identity theft protection and mechanical breakdown insurance are available in Oklahoma.

Cons

- Claims Score: With 628/1,000, AAA’s claims satisfaction lags behind Liberty Mutual in Oklahoma.

- Membership Fees: Oklahoma customers must pay annual membership dues in addition to premiums.

#9 – Safeco: Best for Bundling Options

Pros

- Bundling Value: Oklahoma customers can save up to 20% when combining auto and homeowners policies. Save money on premiums in Oklahoma by checking our Safeco auto insurance review.

- Specialty Coverage: Safeco offers Oklahoma drivers endorsements for rideshare coverage and custom equipment protection.

- Discount Options: Safe-driver and multi-car discounts are available to Oklahoma customers looking to reduce premiums further.

Cons

- Low Service Scores: With 597/1,000, Safeco ranks among the worst Oklahoma auto insurance companies for claims.

- Limited Agent Network: Safeco’s smaller presence in Oklahoma makes in-person assistance less available than larger carriers.

#10 – Travelers: Best for Policy Flexibility

Pros

- Flexible Options: Oklahoma drivers can access endorsements such as accident forgiveness and new-car replacement coverage.

- Eco-Friendly Discount: Travelers discounts Oklahoma customers on hybrid or electric cars. Explore our Travelers auto insurance review for more ways to save.

- Excellent Financial Strength: An A++ A.M. Best rating provides Oklahoma drivers unmatched financial reliability.

Cons

- Low Claims Score: With a score of 585/1,000, Travelers ranks lowest in Oklahoma for claims satisfaction.

- Rate Volatility: Oklahoma customers with poor credit experience greater price swings than those with State Farm or Nationwide.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Car Insurance in Oklahoma

Finding the best auto insurance companies in Oklahoma usually comes down to what best fits your needs, whether it’s State Farm with its reliable claims, American Family with accident forgiveness, or Allstate, which rewards low-mileage drivers with real discounts.

Getting affordable Oklahoma auto insurance prices involves smart choices, such as keeping a clean record, improving your credit, or raising your deductible.

One smart tip is to review your coverage every renewal, as dropping extras on older cars can save hundreds each year.

The easiest way to find your fit is to get multiple auto insurance quotes. The right company will match your budget while providing coverage you can count on. Compare auto insurance rates by simply entering your ZIP code to see what’s available near you.

Frequently Asked Questions

What is the best car insurance in Oklahoma?

The best auto insurance in Oklahoma usually comes down to what drivers need most. State Farm is a favorite for its strong local agent support, while Allstate is the top pick for low-mileage drivers.

What is the most trusted car insurance company in Oklahoma?

State Farm has the highest claims satisfaction in the state and a superior A++ financial rating from A.M Best, meaning customers can rely on it to pay out claims and handle repairs quickly.

What is the average auto insurance cost in Oklahoma?

The average cost of car insurance in Oklahoma is about $144 per month for full coverage and $46 for minimum coverage, with rates higher for teens and auto insurance for high-risk drivers.

Why is car insurance so high in Oklahoma?

Car insurance in Oklahoma is high because the state ranks among the top for tornado and hail claims. Nearly 14% of drivers are uninsured, driving premiums up to cover the associated risk. Rural highway accidents also increase claim frequency.

What is full coverage auto insurance in Oklahoma?

Full coverage auto insurance in Oklahoma combines liability with collision and comprehensive protection. Collision helps pay for repairs to your car after an accident, while comprehensive steps in for things like hail, tornado damage, or theft, which are all pretty common risks in OK.

What is the compulsory insurance law in Oklahoma?

The compulsory insurance law in Oklahoma requires that every vehicle registered in the state carry the minimum liability coverage before it can be driven. Electronic proof of insurance is accepted during traffic stops.

What is the minimum auto insurance required in Oklahoma?

Oklahoma law requires drivers to carry liability auto insurance with at least $25,000 in coverage for one person’s injuries, $50,000 total per accident, and $25,000 for property damage. These limits keep you legal on the road, but they may fall short in a serious crash, leaving you to cover extra costs out of pocket.

Can you self-insure your car in Oklahoma?

Yes, Oklahoma allows self-insurance if you post a $75,000 bond or cash deposit with the Department of Public Safety, which is only practical for businesses or drivers with multiple vehicles.

Is it better to pay auto insurance monthly or yearly in Oklahoma?

Paying yearly is usually cheaper in Oklahoma, as insurers often knock off 5–10% when you pay upfront. Monthly payments are more flexible but usually come with installment fees that raise the total cost.

Can I end my car insurance if I pay monthly in Oklahoma?

Yes, you can cancel a monthly auto insurance plan in Oklahoma, but you must have new coverage in place before doing so. Knowing what happens if you cancel auto insurance is important, as driving without insurance can lead to license suspension, fines, and even vehicle impoundment.

Can my credit rating affect my car insurance in Oklahoma?

Does Progressive cover Oklahoma?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.