American Family vs. Travelers Auto Insurance Review

Uncover how each company stacks up on price, perks, and real customer experiences in our American Family and Travelers auto insurance review.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated September 2025

When it comes to finding the right car insurance, it’s about more than just saving money.

It’s about finding the best car insurance company in your area that offers a solid balance of the protection you need, along with attentive service and affordable pricing.

Sounds simple enough on the surface, right?

In this guide, we’ll take a closer look at two popular auto insurance companies: American Family, also known as AmFam, and Travelers Insurance.

Whether you’re comparison shopping or trying to narrow down your decision between these two well-known brands, our guide will present the facts and customer reviews of American Family and Travelers Insurance to help you make a more informed decision.

Let’s take a closer look:

Types of Insurance Products Each Company Offers

Both American Family and Travelers offer your typical auto insurance lines, including comprehensive insurance, liability/underinsured/uninsured motorist insurance, and collision insurance, but they also offer insurance coverage beyond the basics.

Travelers Auto Insurance Coverage Options

- Gap Insurance: This protects your car lease or loan in the event that your car is totaled before the lease is up or before it is paid in full. In this case, gap insurance kicks in and pays off the remainder. Without this insurance, you would have to pay the difference between the loan balance and the car’s value when it was totaled.

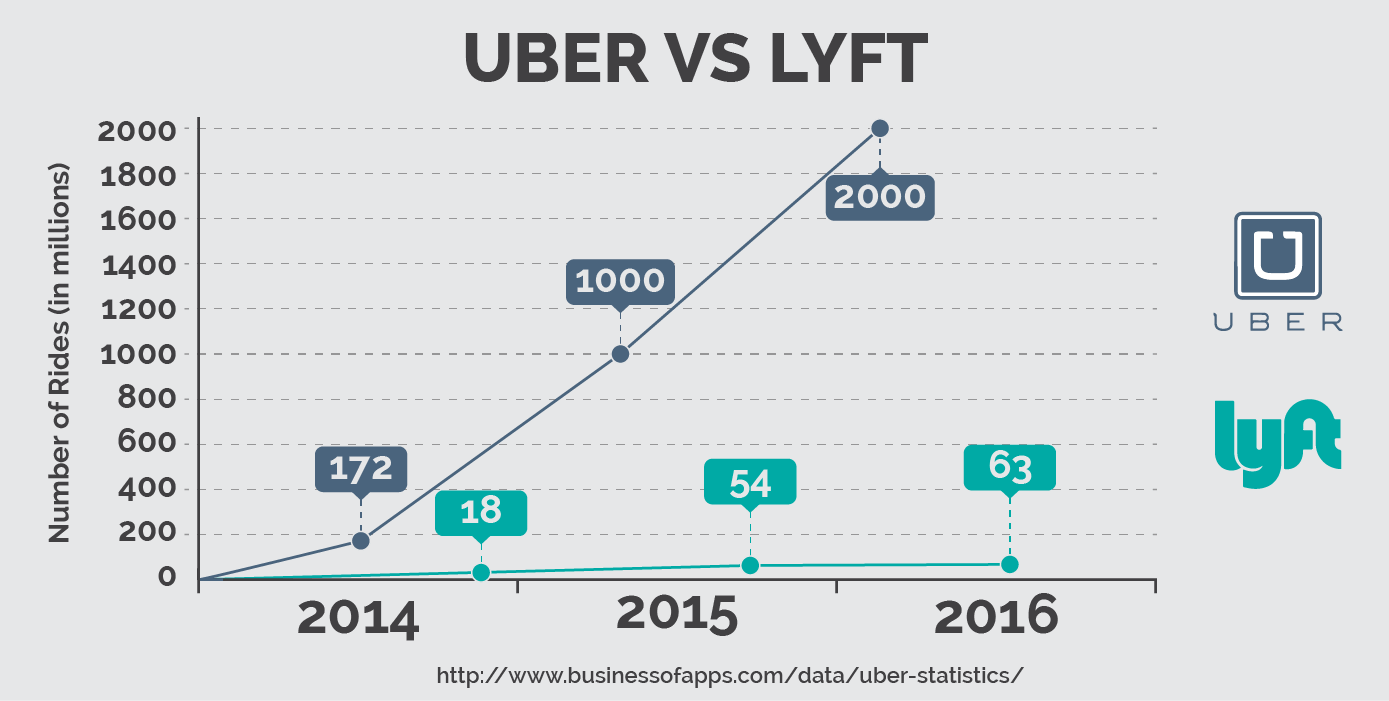

- Ridesharing Insurance: Thanks to the popularity of services like Uber and Lyft, Travelers customers in Illinois and Colorado can opt for ridesharing insurance. Ridesharing companies typically cover some liability in the event of an accident when drivers are en route to pick up or drop off a passenger, but not during the time between rides.

- Travelers Intellidrive: Although not available in every state, Intellidrive is an app that collects metrics based on how you drive—including location, time of day, average speed, acceleration and braking, and number of miles driven. Currently, the program is only available to users in Minnesota or Nevada. Intellidrive requires a smartphone and tracks your driving behavior—with a discount for safe driving habits.

American Family Auto Insurance Coverage Options

In addition to traditional car insurance policies, American Family also offers gap insurance and ridesharing insurance. In addition, they also provide the following additional options:

- Accidental Death and Dismemberment: An insurance option that pays in the event that an accident causes death or limb dismemberment, regardless of who is at fault.

- Teen Safe Driver: Similar to Travelers’ IntelliDrive app, this mobile app is part of a program designed to help teens develop safe driving habits. As long as their smartphone is in the car, it tracks their driving and scores their rides, while also providing feedback. The company claims that the app is smart enough to tell who’s at the wheel, but if it does happen to log one where someone else is driving, you can delete that log. Once your teen driver completes a year or 3,000 hours in the program, parents can get up to a 10% discount on their car insurance.

Some policies may also offer extras, including things like breakdown insurance, which you’ll want to evaluate as to how necessary it is given your vehicle, its age/condition, and other factors.

Free Auto Insurance Comparison

Compare Quotes from Top Companies and Save

Secured with SHA-256 Encryption

Insurance Rates for Each Company

The rates for American Family and Travelers Insurance vary considerably depending on many factors.

The amount of insurance you need, the vehicle you’re insuring, the state you live in, how many drivers are on the policy, the ages of each driver, and so on.

The best way to obtain rates is to request a quote tailored to your specific situation.

It costs you nothing and only takes a few minutes—and you’ll get a more personalized quote that fits your needs and situation.

Of course, understanding how car insurance companies price their policies can also help you better learn how companies like Travelers and American Family actually set their rates. Discover how to get the cheapest car insurance.

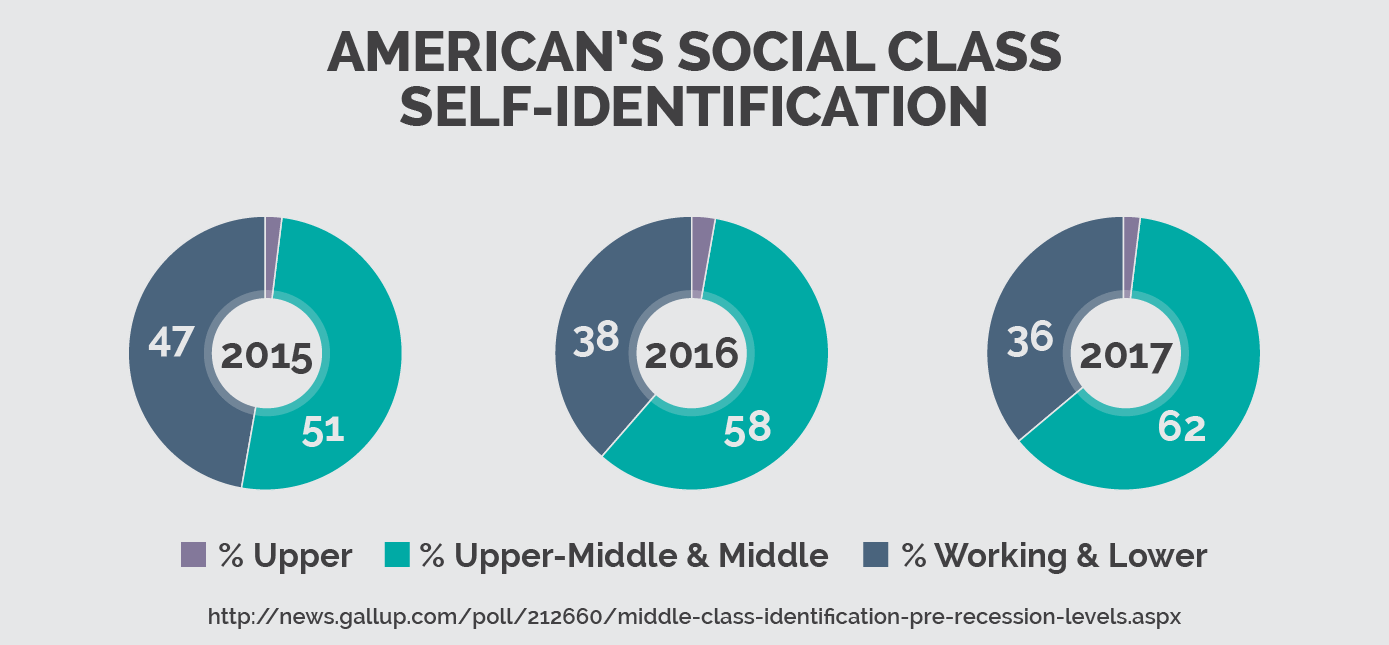

For example, you may be surprised to learn that your high insurance rates can be due to your race or even your socioeconomic status.

This may sound blatantly discriminatory, but there are concrete reasons why insurance is priced this way.

For example, insurance companies use several markers to gauge risk, which is the primary indicator of whether rates go up or down.

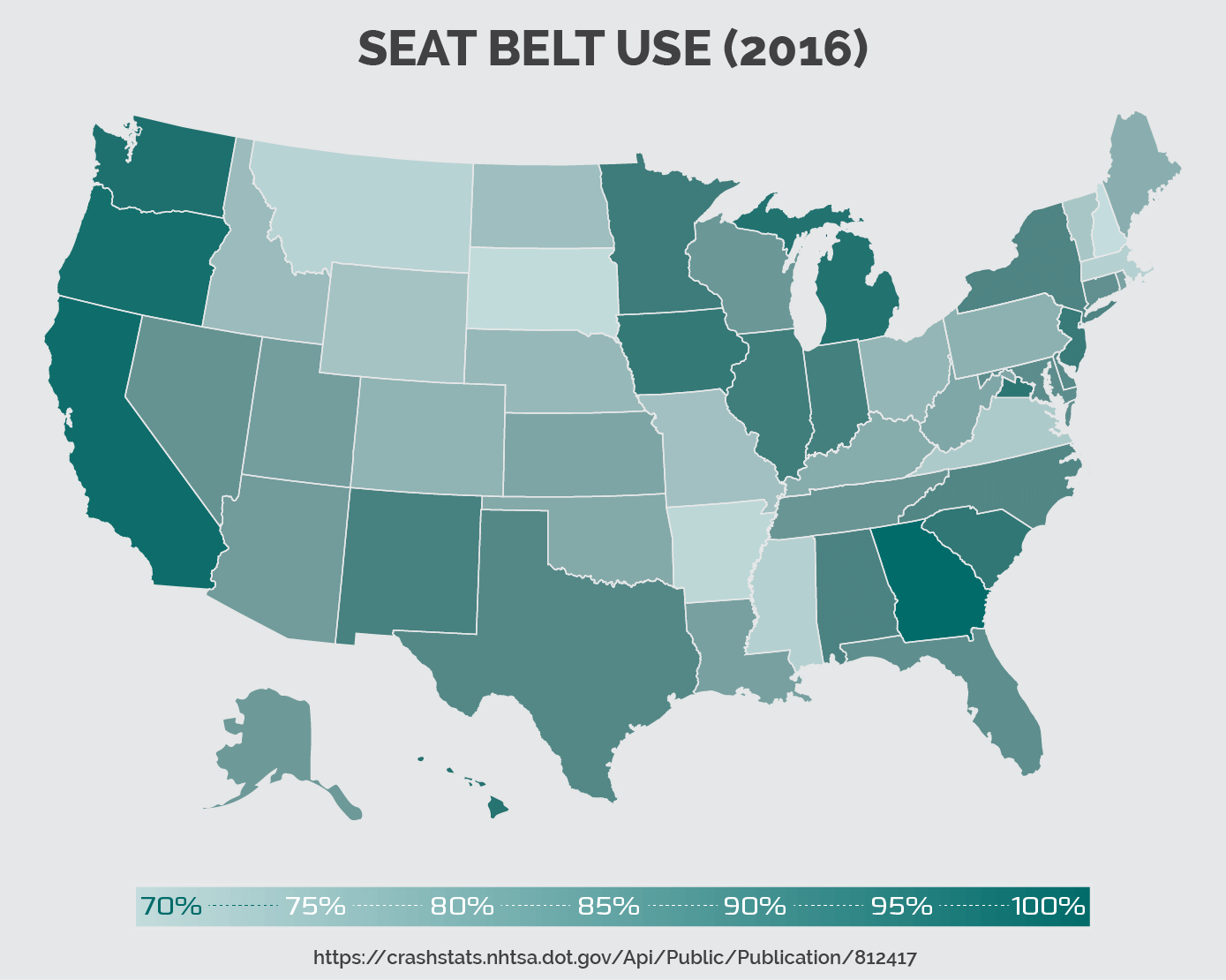

Where you live, your driving record, the vehicle you drive, and its safety or anti-theft features—all of these things contribute to how much or how little of a risk you are.

Even things like your education level or whether or not you’re married can contribute to how much you pay for insurance.

Available Discounts From Each Company

Both companies offer a wide range of car insurance discounts. Oftentimes, you may even be eligible for discounts that are not listed here, such as a discount for installing an anti-theft device on your vehicle.

Be sure to ask about any additional discounts you may be eligible for when requesting your free quote.

American Family Auto Insurance Discounts

There are several discounts for which you may qualify:

- Multi-Vehicle Discount: If you insure more than one vehicle with American Family, you may qualify for a reduced premium on your cars and trucks.

- Loyalty Discount: The longer you’re an American Family customer, the more you can save.

- Early Bird Discount: You may qualify for a discount if you have a car insurance policy with another carrier and get a quote from American Family at least seven days before the policy goes into effect.

- Multi–Product Discount: If you have, for example, home and auto insurance with American Family, you’ll enjoy a discount.

- “Steer Into Savings” Discount: You may be eligible for a discount from American Family if you switch from a competitor.

- Auto Safety Equipment Discount: Depending on the state you live in, if your vehicle is equipped with factory-installed airbags or other safety features, you may be eligible for a discount of up to 30% on your policy.

- Defensive Driver Discount: Depending on the state you live in, if you are 55 years or older, you could get a 5-10% discount if you complete an approved defensive driving course.

- Good Driving Discount: Drivers who practice safe road habits and avoid any moving violations, claims, or accidents can receive a reduced premium rate in certain states.

- Low Mileage Discount: If you drive less than 7,500 miles per year, you may qualify for additional savings through American Family’s low mileage discount program.

- Good Student Discount: Students who maintain good grades could enjoy savings on insurance premiums.

- Teen Safe Driver Discount: A free program that parents can enroll their teen driver in, the Teen Safe Driver program helps young drivers make better choices behind the wheel and may qualify them for a discount on their policy.

- Away at School Discount: If you’re a student under the age of 25 who is more than 100 miles away at college and haven’t taken a car with you (or if you have a child who fits these criteria), you can save money.

- Young Volunteer Discount: If you’re under the age of 25 and you complete 40 hours or more of volunteer work in a year for a non-profit organization, you could save money on your policy.

- Generational Discount: If your parents are American Family customers and you’re between the ages of 18-24, you could get a generational discount.

- KnowYourDrive Discount: KnowYourDrive is a program available in select states that evaluates your driving habits and provides you with tips on staying safe on the road. You may be able to earn discounts of up to 40% on your car insurance.

Free Auto Insurance Comparison

Compare Quotes from Top Companies and Save

Secured with SHA-256 Encryption

Travelers Auto Insurance Discounts

No shortage of possible discounts here either:

- Safe Driver Advantage: The Safe Driver Advantage offers a discount to drivers who have no accidents, violations, or major comprehensive claims in their households.

- Paid-in-Full Discount: Customers who pay their car insurance premiums in full can receive a discount of up to 5%.

- Multi-Car Advantage: Insuring more than one car with Travelers entitles customers to a multi-car discount.

- Early Quote Advantage: Similar to American Family’s Early Bird discount, users who plan ahead and obtain a quote from Travelers before their current auto insurance policy expires may enjoy an Early Quote Advantage.

- Multi-Policy Discount: Combining Travelers car, home, and boat insurance can give customers savings of up to 15% on each policy.

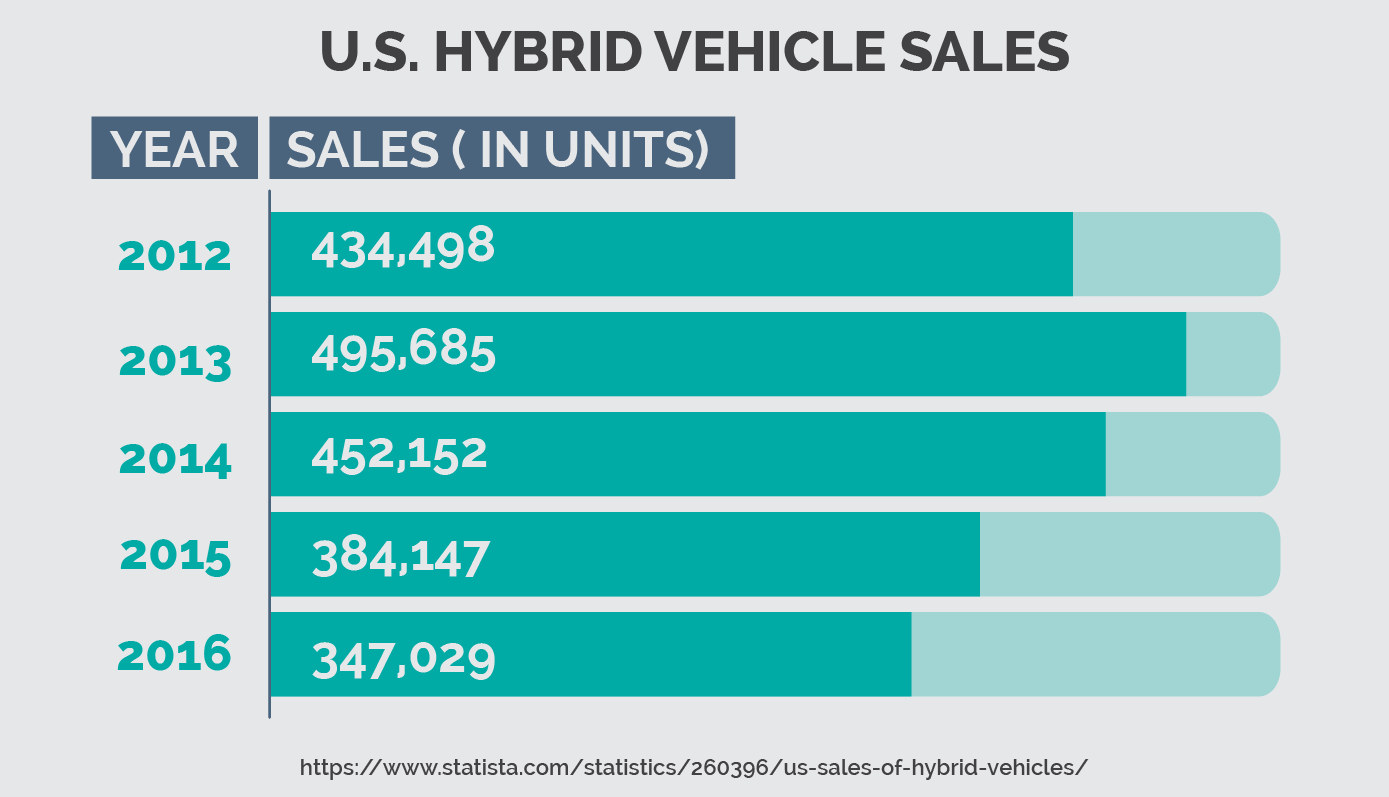

- Hybrid Vehicle Discount: Get up to 10% off your insurance for a hybrid vehicle.

- Good Student Discount: Students with an A/B average or higher can qualify for a discount by maintaining their good grades.

- Driver Training Discount: Drivers under the age of 21 who complete an eligible driver training course may qualify for this discount.

- Student Away at School Discount: Policyholders with a dependent under the age of 25 who attends a school 100 miles or more away may be eligible for this discount.

- Home Ownership Discount: Policyholders who own their home or condominium may be eligible for this discount.

- Accident Forgiveness: Customers who have been with Travelers for four years or more and have had no major incidents for five years are eligible for a surcharge waiver for the first accident.

Benefits and Features From Each Company

In addition to the multi-policy discounts and features noted above, both companies offer a variety of additional perks.

Both companies are also looking toward incorporating apps (although this is currently only available in certain areas), which monitor your driving and evaluate you accordingly.

This showcases the insurance carriers’ push to tie driving habits and therefore rates to a specific driver rather than lumping all drivers into a typical “risk pool” based on what they drive, their background, where they live, and so on.

You can likely expect more carriers to adopt this more personalized approach in the future, so it’s certainly something worth thinking about now.

Be sure to ask your agent when you apply for a free quote if they offer an app or other means to quickly file a claim or get assistance if needed.

You’d be surprised at how this can come in handy when you’re in the midst of an accident and thinking about insurance paperwork is the LAST thing on your mind!

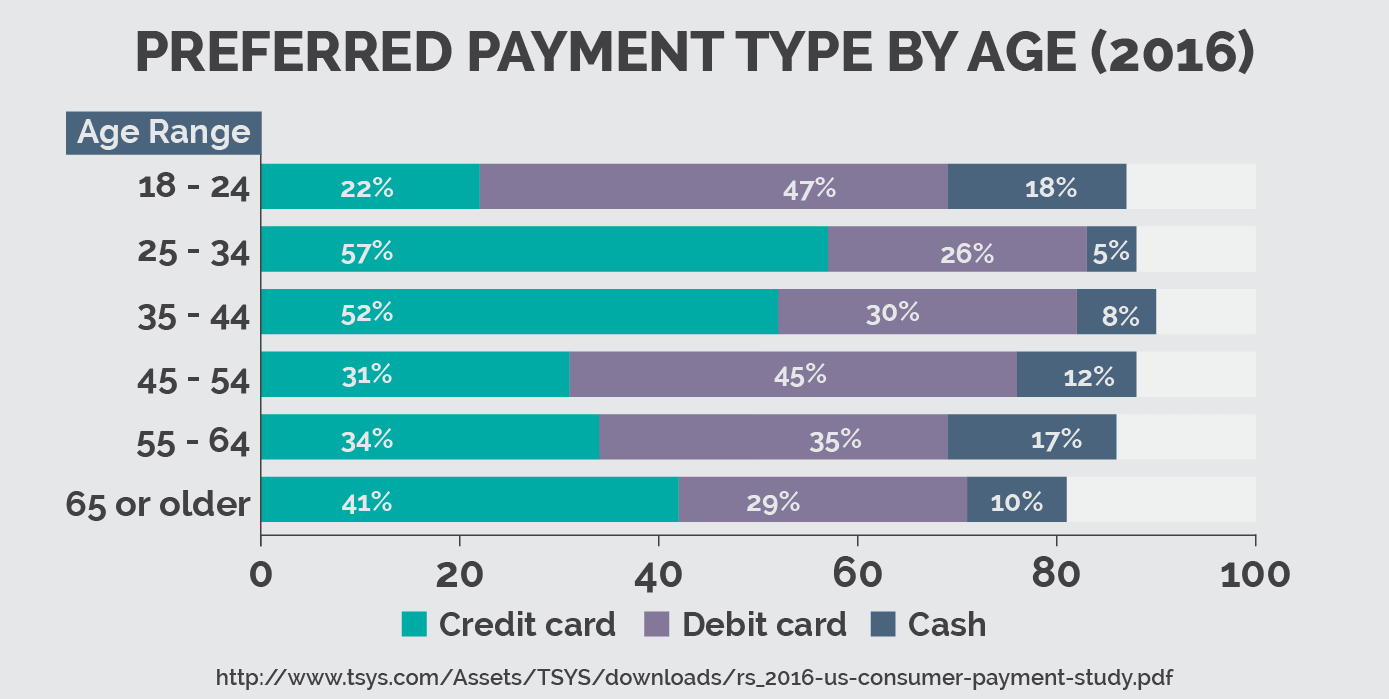

Available Payment Options From Each Company

Both American Family and Travelers Insurance offer multiple convenient options for paying for your coverage.

American Family offers autopay, which allows you to set up automatic funds transfer online (also known as paperless billing) and qualify for a discount when you do.

You can also get a discount if you pay your policy in full.

Travelers also offers similar payment options, including paying your bill online, by mail, or by phone (using voice recognition).

Free Auto Insurance Comparison

Compare Quotes from Top Companies and Save

Secured with SHA-256 Encryption

How to Get a Free Quote From Both Companies

Getting a quote from either American Family Insurance or Travelers Insurance is easy and hassle-free.

You can obtain a no-obligation quote directly through our website and compare the two providers to determine which one is right for your specific needs.

Getting a customized quote in this way is better than searching for generic car insurance rates online, as it’s more tailored to your vehicle, the state you live in, and others on your policy (such as teenage or college-aged drivers), among other factors.

And remember, obtaining a free quote from both of these companies costs you nothing except a few minutes of your time. Save time and money by getting your quote online.

How to Get Multiple Policies From Both Companies

Car insurance companies, as a whole, are generally similar in terms of the policies they offer, although some, like Travelers, have adopted a more forward-thinking approach by offering discounts for hybrids, for example.

The best way to find out which company is right for your specific needs is to get a free quote and ask about what discounts you’re eligible for.

Saving money and being able to file a claim and contact an agent nearby are also points to consider.

Both American Family and Travelers Insurance offer multiple types of policies, including home, boat, and motorcycle insurance.

You can get multiple policies from both companies and are actively encouraged to do so, as it may save you money by bundling your policies under one company—plus give you a central way to manage your account, view claims, and so on.

Specific States Each Company Serves

Both companies only serve specific states, and depending on where you live, certain programs may or may not be offered.

The best way to know for sure is to request a free quote online and determine what programs, discounts, and other features are available in your area.

For reference, each company serves the following states:

American Family Insurance

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- Nevada

- North Dakota

- Ohio

- Oregon

- South Dakota

- Utah

- Washington

- Wisconsin

Travelers Insurance

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington, DC

- Wisconsin

It’s worth noting that even if the carrier you’re considering isn’t available in your state, both companies are growing and expanding, and may offer coverage in your area soon.

Free Auto Insurance Comparison

Compare Quotes from Top Companies and Save

Secured with SHA-256 Encryption

What Customers Say About the Customer Service of Each Company

J.D. Power ratings and online complaints should be taken into consideration.

To gain an accurate understanding of how companies are reviewed, it’s essential to consider factors such as J.D. Power ratings and any complaints that have been filed against them, according to data from the NAIC, or the National Association of Insurance Commissioners.

American Family’s customer service ratings are above average for car insurance, and the company itself generally has fewer complaints than similarly sized companies.

Travelers’ customer satisfaction ratings are average or better, and the company also has fewer complaints than its similarly sized competitors.

Of course, many customers comment on being involved in accidents with other vehicles insured by these respective companies, only to find that the claims are still under investigation months later.

Other customers claim that the companies try to lure you in with deceptively low prices only to raise them suddenly and without explanation.

Still, overall, the reviews compared to the size and breadth of the companies and their representation in each state can still be said to be above average.

The best way to gain insight beyond reading online reviews is to consult with your local agent and ask friends, family, or colleagues who are insured with each respective company about their experiences.

What Other Customers Say About Each Company’s Policies

Customer complaints often impact other types of insurance, beyond car insurance, such as homeowners’ insurance.

It’s important in this case to understand fully what your insurance does and does not cover, as well as what to do if you have been denied car insurance.

In some cases, customers have even had their plans, or the options they’ve included, suddenly canceled when they used them “too much”.

Or they discovered that their agent had misinformed them—or hadn’t informed them at all—of a certain rider or option they needed to obtain coverage in a specific incident.

Here again, every customer is different, which is why it’s essential to obtain a quote online and discuss your concerns with an agent. This allows you to document the chat and print out the results.

It’s worth noting that despite the overwhelmingly poor reviews you may read online, every customer and every situation is different.

Even though a particular instance may seem skewed, you’re only reading the review from the perspective of the user who feels victimized—the insurance company may simply be following the rules and regulations outlined in the user’s policy.

Seeing only one side of the story can lead to a significant imbalance in reviews and reputation.

The Insurance Company That Gives You the Best Policies and Services

If you live in a state serviced by both American Family and Travelers and are seriously considering choosing between the two, it may be helpful to obtain quotes for both.

With just a few basic details, you can obtain a quote directly online that’s tailored to your specific needs, vehicle(s), drivers, and more.

Additionally, by obtaining quotes online from both companies, you can easily compare their features and optional extras, as well as any discounts for which you may be eligible.

It’s worth noting that both companies pull ahead of each other for different reasons.

For example, American Family Insurance offers a generational discount if your parents have been policyholders with them, and you’re striking out on your own and in need of affordable insurance.

Travelers, on the other hand, has earned its reputation for offering insurance on cutting-edge products and services like hybrid cars.

It’s also worth noting that you can save a significant amount on your policy by bundling your home and car insurance with the same company.

These, in addition to other discounts, can add up quickly in your favor, so it’s a smart idea to get an online quote and determine just how much savings you may be entitled to—it could surprise you!

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.