Special Enrollment Period (SEP) for Medicare

The Special Enrollment Period (SEP) for Medicare ranges from two to eight months after a qualifying life event, such as the loss of a job or moving. SEP is outside of the open enrollment period and helps people avoid coverage gaps or losses. Address changes account for 32% of all Medicare SEP cases.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated September 2025

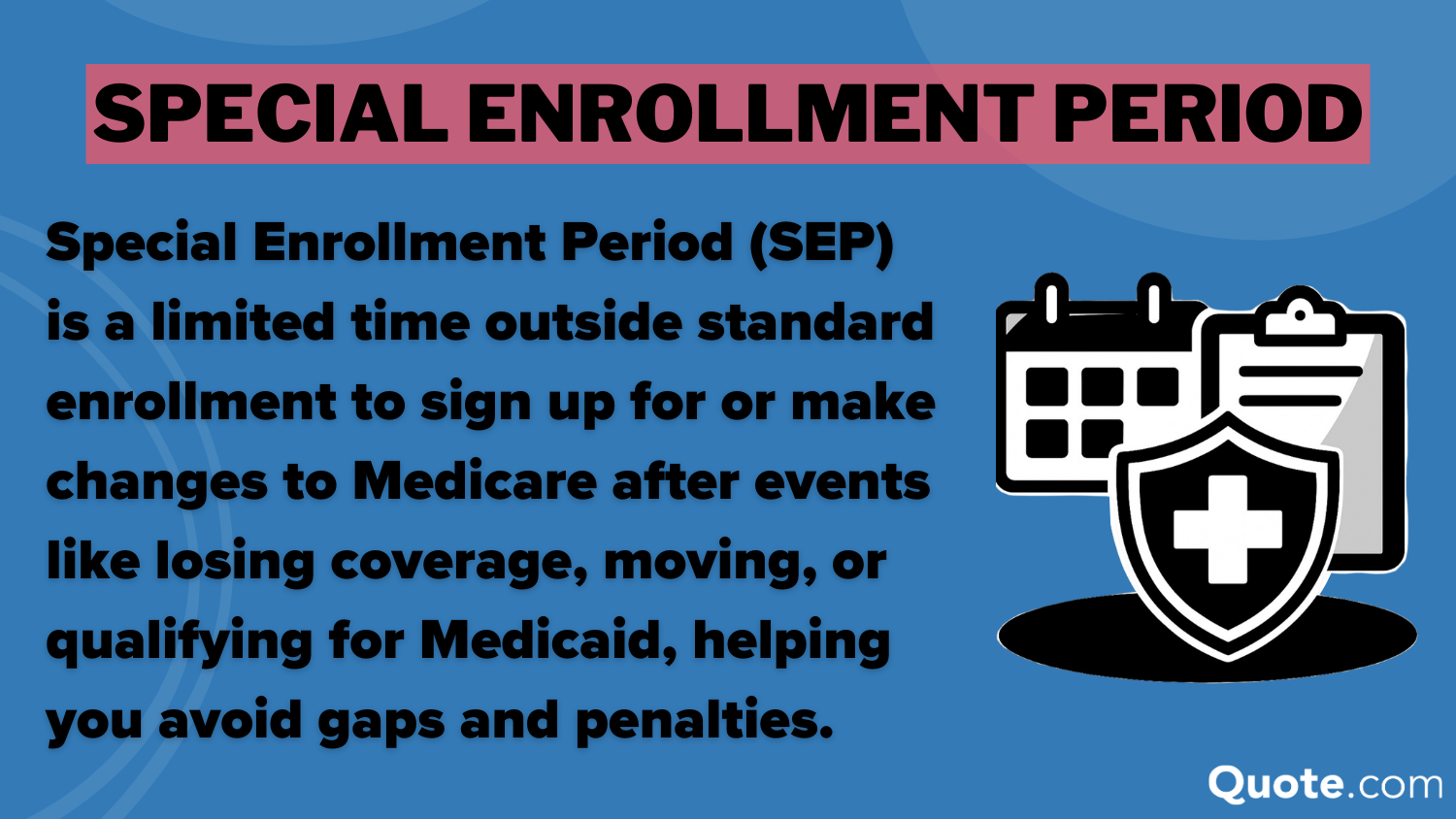

The Medicare Special Enrollment Period (SEP) allows people who have had a recent life event that resulted in loss or change of coverage to sign up for Medicare outside of the Medicare General Enrollment Period.

- Medicare Special Enrollment Periods vary according to the event

- Special Enrollment Periods help people avoid coverage gaps or losses

- Keep records of qualifying life events for your Medicare application

While not every life event will qualify, some common events that generally result in being able to sign up for Medicare outside of the regular enrollment period include loss of coverage or moving. Read on to learn about Medicare SEP qualifying life events, deadlines, start dates, and much more in our expert guide to Medicare enrollment.

To speak with a licensed insurance agent about your Medicare needs, call (855) 634-0435 today. You may also enter your ZIP in our free tool for quotes.

Medicare Special Enrollment Period Explained

The Medicare Special Enrollment Period is a limited-time window outside the standard open enrollment periods for customers who meet the qualifications for a special event.

If you need to sign up for Medicare insurance because of a qualifying life event, you will typically have up to two to eight months after the special event to sign up for coverage (Read More: How to Sign up for Medicare).

Medicare Special Enrollment Periods exist to allow people to adjust or get health insurance coverage after life changes without major penalties.

These special enrollment periods are important because they help people avoid a lapse in health insurance, as being without health insurance for even a month or two could have disastrous financial repercussions.

Special Enrollment Period: Pros & Cons| Pros | Cons |

|---|---|

| Avoids late penalties (Part B & D) | Short deadlines (2-8 mo) |

| Prevents coverage gaps | COBRA & retiree plans don’t extend SEP |

| Switch plans for life events | Missed SEP = wait until Jan-Mar |

| Covers job, move, Medicaid & disasters | Rules vary, not all events qualify |

| Protects in emergencies or errors | Coverage starts month after enrollment |

| Keeps drug & Advantage coverage | Rules can be complex & confusing |

However, there are some cons to Medicare Special Enrollment Periods, namely that the rules for qualifying can vary and be confusing.

To help ensure you don’t miss the opportunity to sign up for Medicare coverage during a Special Enrollment period, we will review everything you need to know about qualifying for coverage.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

When You Qualify for Medicare Special Enrollment

Not every life event that results in someone losing health insurance will qualify for the Medicare Special Enrollment Period (Read More: Medicare Coverage and Eligibility).

Some common events that usually qualify people to enroll in Medicare outside of the standard enrollment period include loss of a job, loss of coverage, and more.

Rules for enrollment can vary based on the life event and the type of Medicare coverage, so we recommend checking Medicare.gov or calling 1-800-MEDICARE for individual cases.

Generally, the most common qualifying events that will result in approval for enrollment outside of Medicare’s standard periods include:

- Moving: This could be a change of residence or facility.

- Coverage Loss: This could be coverage loss from a job, union, COBRA, or Medicaid.

- Eligibility Changes: This could be changes in Medicaid or Extra Help eligibility.

- Plan Changes: This could be because your insurer leaves Medicare, or the contract ends.

- New Coverage: This could be a job, a union, or sometimes VA-related coverage.

A change of address is the most common reason for needing to use the Medicare Special Enrollment Period, accounting for 32% of all cases.

Coverage loss is another common reason, with 26% of Medicare Special Enrollment Period cases being due to loss of health insurance coverage (Learn More: The Complete Guide to Health Insurance).

Medicaid changes and new coverage account for 16% each of cases applying for the Medicare Special Enrollment Period, while plan changes account for 10%.

If you are experiencing any of these major life events that are common for Medicare application cases, then you may qualify for coverage. If you are having trouble affording Medicare coverage, see if you can qualify for Medicare Savings Programs.

Important Medicare Special Enrollment Dates & Deadlines

It is important to note that each qualifying event for Medicare coverage comes with its own stipulations and time constraints.

For example, people who lose their Medicaid coverage only have two months after the loss to apply for Medicare coverage, so it is important to check the Medicare special enrollment period charts to make sure you don’t miss a deadline.

Special Enrollment Period (SEP) Eligibility Details| Qualifying Event | Enrollment Window | Coverage Start |

|---|---|---|

| Employer union plan ends | 8 mos after coverage ends | Month after enroll |

| Assisted living move | In facility + 2 mos after | 1st of next month |

| Move outside plan area | 2 mos after move | 1st of next month |

| New plan options available | 2 mos after change | 1st of next month |

| Loss of Medicaid coverage | 2 mos after loss | 1st of next month |

| Retirement or COBRA ends | 8 mos after job coverage | Month after enroll |

| Gain employer coverage | 8 mos after start | Month after enroll |

| Gain union coverage | 8 mos after start | Month after enroll |

| Veteran benefits change | Per VA Medicare rules | 1st of next month |

| Plan contract changes | 2 mos after change | 1st of next month |

The timeframe for action varies depending on the event and situation, ranging from two to eight months after a qualifying life event.

It is important to know the applicable deadline for your qualifying life event, as missing the Medicare Special Enrollment Period may mean that you have to wait for the General Enrollment Period. This could leave you without coverage for an extended period, depending on when you lost your health insurance (Read More: How to Finance What Your Health Insurance Won’t Cover).

Typically, Medicare health insurance plans will start on the 1st of the next month after a customer enrolls for coverage. For example, if you sign up for a Medicare plan on October 18, coverage won’t start until November 1.

There may be some exceptions to Medicare coverage starting on the first of the month, although the first of the following month is the most common start date.

Employer and union health insurance coverage may start the month of enrollment instead of the next month.

Adam Lubenow Medicare Broker

It is important to note that, in addition to the regulations on start dates, Medicare Special Enrollment Periods also only allow certain changes to be made to coverage.

As well, not all Special Enrollment Periods apply to every type of Medicare, as some are exclusively special enrollment periods for Medicare Advantage (Read More: What is Medicare Advantage?).

Changes Allowed in Medicare Special Enrollment Periods| Medicare Part | SEP Options | Details |

|---|---|---|

| Part A – Hospital Insurance | Apply if not auto-enrolled | Penalty-free if you had employer coverage |

| Part B – Medical Insurance | Enroll without penalty | SEP prevents late penalty when leaving job or union coverage |

| Part C – Medicare Advantage | Join, drop, or switch plans | Advantage SEPs include moving or plan contract changes |

| Part D – Drug Coverage | Join, drop, or switch plans | SEPs ensure no gap when drug coverage is lost or changed |

For example, with the Medicare Part C and Medicare Part D special enrollment period, you can join, drop, or switch plans.

However, the Special Enrollment Period for Medicare Part A only allows customers to apply for Medicare Part A if they are not auto-enrolled.

As for the Medicare Part B Special Enrollment Period, you can apply online for Medicare Part B during a Special Enrollment Period without penalty.

It is important to note that Medicare’s Special Enrollment Periods help customers avoid the late-enrollment penalties for Part B or Part D that would normally be charged in other situations.

Make Sure You Don’t Miss Medicare Special Enrollment Periods

No one wants to be without health insurance coverage, so making sure you don’t miss your special enrollment period is vital to protecting yourself.

Even if you have months to secure Medicare insurance coverage during a SEP, it is best not to delay enrolling in Medicare coverage.

If you wait until the last minute and have issues signing up, it could result in having to wait for the Medicare General Enrollment Period. You also want to leave yourself time to research coverage options, such as deciding if you want add-ons like Medicare Supplemental Insurance (Medigap).

Some other practical tips to follow when applying for Medicare coverage during a Special Enrollment Period include:

- Keep Event Records: Make sure to keep proof of the qualifying event, such as proof of your move date or loss of coverage.

- Compare Plan Options: Don’t just blindly sign up for coverage; make sure to compare Medicare Parts A, B, C, & D to get the best one for your health insurance needs.

Medicare enrollment can be confusing, but making a plan of action and not waiting until the last minute will help ensure you aren’t left without health insurance coverage.

To speak with a licensed insurance agent about your Medicare needs, call (855) 634-0435 today. You may also enter your ZIP in our free tool for quotes.

Frequently Asked Questions

What is the Medicare special enrollment period (SEP)?

The Medicare SEP is a special enrollment period for people who need coverage outside of Medicare’s annual enrollment period due to a qualifying life event.

What are the 3 enrollment periods for Medicare?

The three enrollment periods for Medicare are the Initial Enrollment Period (IEP), the General Enrollment Period (GEP), and the Special Enrollment Period (SEP).

What qualifies you for a special enrollment period?

Why would someone get a Medicare SEP? There are several events that may qualify for a special enrollment period, though rules and regulations vary by event and coverage type. The main events include changes in residence, loss of coverage, job loss, changes in eligibility or coverage, and new coverage.

The rules vary by event, but the basic rules are that people must qualify for one of the events that trigger special enrollment and apply for coverage within the SEP deadline. If you want to learn more about coverage and costs before your special enrollment period comes up, read our guide on how much Medicare costs.

How do I verify my SEP eligibility?

You can submit an application to see if you qualify for Medicare coverage during an SEP event. Talking with a licensed insurance agent can help. Call (855) 634-0435 to get the help you need or enter your ZIP code to compare Medicare plans near you.

Can you go back to original Medicare during open enrollment?

Yes, you can make the change from Medicare Advantage to Medicare Original during the open enrollment period.

What can you do during a Medicare SEP?

How many changes can you make during a Medicare SEP? It depends on what coverage you are applying for. Medicare Part C and D SEPs allow you to join, drop, or switch plans, while Medicare Part A SEPs only allow you to apply if you are not auto-enrolled. Medicare Part B SEP will enable you to enroll without penalty.

What would not qualify an individual to use a special enrollment period?

An individual would not qualify for a SEP if they don’t have a qualifying life event.

What happens if I do nothing during Medicare open enrollment?

If you are already enrolled in Medicare before open enrollment, then your current coverage will be renewed unless you receive notification stating otherwise. If you aren’t enrolled, then not enrolling during open enrollment could leave you without coverage unless you meet the qualifications for a special enrollment period.

When does Medicare coverage start?

Whether you are applying for Medicare Advantage or Original Medicare, the start date for Medicare coverage during special enrollment periods typically starts on the first of the month after you apply. So if you apply in October, your coverage will start on November 1 if you are approved.

What is the 8-month SEP for Medicare?

There are a few special events that have an 8-month time period. You have eight months if your employer union plan, retirement, or COBRA ends, or you gain employer or union coverage.

Where can I find a list of Medicare SEP codes?

What is the biggest disadvantage of Medicare Advantage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.