Best Discounts for Vehicle Garaging and Storing in 2026

The best discounts for vehicle garaging and storing are with Allstate, Progressive, and USAA. These companies offer up to 18% savings when you park in a garage or secure storage. Stack garaging discounts with low-mileage or bundling rewards to lower premiums on vehicles you don't drive often.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Joel Ohman

Updated September 2025

Allstate, Progressive, and USAA provide the best discounts for vehicle garaging and storing, helping drivers save up to 18%. These three providers combine low premiums with multiple savings opportunities, making them the best car insurance companies for drivers who want to maximize the perks of garage parking.

- You can earn garaging discounts by storing your car in a secure, covered facility

- Allstate offers up to 18% garaging discounts and is a top pick for coverage

- USAA has the cheapest car storage insurance discounts, saving you up to 12%

USAA offers the lowest rates for eligible military drivers who store their vehicles while deployed. Progressive provides strong garaging savings with flexible usage-based options, and Allstate delivers broad discounts that drivers can stack for better coverage and savings.

Top 10 Companies: Best Discounts for Vehicle Garaging and Storing| Company | Rank | Garaging Discount | Low Mileage | Who Qualifies? |

|---|---|---|---|---|

| #1 | 18% | 30% | Parked in Private Garage / Annual Mileage Under 7,500 Miles |

|

| #2 | 15% | 30% | Kept in Secured Garage / Annual Mileage Under 10,000 Miles |

|

| #3 | 12% | 20% | Stored on Military Base / Annual Mileage Under 7,500 Miles |

|

| #4 | 12% | 10% | Parked in Home Garage / Annual Mileage Under 10,000 Miles |

|

| #5 | 11% | 30% | Parked in Secure Garage / Annual Mileage Under 7,500 Miles |

| #6 | 10% | 20% | Locked Garage Storage / Annual Mileage Under 8,000 Miles |

|

| #7 | 10% | 20% | Parked in Home Garage / Annual Mileage Under 7,500 Miles |

| #8 | 9% | 20% | Stored in Secure Location / Annual Mileage Under 8,000 Miles |

|

| #9 | 8% | 30% | Locked Garage Storage / Annual Mileage Under 7,500 Miles |

|

| #10 | 7% | 30% | Secured Garage Storage / Annual Mileage Under 7,500 Miles |

Get the best car storage insurance discounts by entering your ZIP code into our free comparison tool. Instantly compare multiple insurers to find the cheapest auto insurance rates for garaging or storing your vehicle, and start saving today.

How Garaging Discounts Lower Your Premiums

Garaging discounts provide noticeable savings across insurers, lowering monthly premiums by $3 to $16, depending on the company. USAA offers the lowest monthly rates, dropping from $32 to $28 for minimum coverage.

Auto Insurance Monthly Rates: Before & After Garaging Discount| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $87 | $71 | |

| $62 | $56 |

| $76 | $67 | |

| $43 | $40 | |

| $96 | $85 |

| $63 | $57 | |

| $56 | $48 | |

| $47 | $44 | |

| $53 | $48 | |

| $32 | $28 |

USAA is only available to military members, so Geico and State Farm are the next picks for the lowest rates before and after the discount. However, Geico’s garaging discount only reduces monthly rates by $3, compared to Allstate, which cuts rates by $16 per month. See our Geico vs. Allstate insurance review for more comparisons.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Rates for Stored Vehicles

Even with big savings for drivers who garage or store their vehicles, auto insurance rates vary widely by insurer and coverage level. USAA is the cheapest at $32 per month for minimum coverage and $84 monthly for full coverage, though limited to military families.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

For most drivers, Geico and State Farm offer the most affordable premiums, while Progressive, Nationwide, American Family, and Travelers stay under $170 a month for full coverage. Allstate is the most expensive company for both types of coverage, but its big discounts can help offset higher rates. See more details in our Allstate insurance review.

But even with discounts, parked car insurance rates are the highest for younger drivers. Cheap auto insurance for teens is harder to find since they have less experience behind the wheel. Insurers view them as higher risk, so premiums remain elevated even when the vehicle is stored.

Auto Insurance Monthly Rates by Provider & Driver Age| Insurance Company | Age: 16 | Age: 25 | Age: 35 | Age: 45 | Age: 55 | Age: 65 |

|---|---|---|---|---|---|---|

| $371 | $102 | $95 | $87 | $82 | $86 | |

| $296 | $78 | $72 | $62 | $59 | $61 |

| $452 | $98 | $89 | $76 | $72 | $75 | |

| $178 | $50 | $47 | $43 | $41 | $42 | |

| $464 | $119 | $110 | $96 | $91 | $95 |

| $279 | $81 | $75 | $63 | $59 | $62 | |

| $467 | $77 | $70 | $56 | $52 | $55 | |

| $208 | $60 | $55 | $47 | $45 | $47 | |

| $517 | $62 | $58 | $53 | $50 | $53 | |

| $146 | $46 | $42 | $32 | $30 | $31 |

At age 16, drivers pay as much as $517 per month with Travelers and over $450 monthly with Progressive, Liberty Mutual, and Farmers. USAA, Geico, and State Farm remain the cheapest companies for young drivers garaging their vehicles.

More Ways to Save Money on Stored Car Insurance

Where you keep your car affects insurance costs, and the top auto insurance discounts for vehicle garaging and storing help reduce risks like theft or damage. Along with parking safely, combining garaging discounts with other discounts and following these strategies can help you unlock big savings.

- Secure Storage Units: Storing a vehicle in a monitored facility when not in use, especially for seasonal cars, can qualify for additional discounts.

- Private Driveway Parking: Even if you don’t have a garage, parking in a private driveway is often considered safer than street parking and may help reduce costs.

- Long-Term Storage Policies: For vehicles not driven year-round, insurers may offer parked car insurance or reduced premiums while the car is garaged.

- Low-Mileage and Pay-as-You-Go Discounts: Combining garaging with low annual mileage reporting and pay-as-you-go insurance can maximize savings, since rarely driven vehicles are lower risk.

- Higher Insurance Deductibles: Raising your auto insurance deductible on a stored car to $1,500 or more will significantly lower your monthly premium.

Garaging discounts not only help lower your premiums but also provide added protection against risks like theft, vandalism, and weather-related damage. Even if you don’t always park in a garage, using these strategies can reduce your overall rates.

Auto insurance rates for garaged vehicles reflect your risk. Raising deductibles can cut costs if you’re prepared to cover out-of-pocket expenses.

Jeff Root Licensed Insurance Agent

The most effective way to maximize savings is by comparing multiple insurance companies side by side. This makes it easier to identify cheap car insurance rates. You’ll also find the best discounts for garaged vehicles, helping you secure the lowest possible cost.

Usage-Based Auto Insurance Programs for Stored Vehicles

Usage-based auto insurance (UBI) programs reward safe habits with discounts tracked by mobile apps or in-vehicle devices. Garaged vehicles that aren’t driven often can get much cheaper rates with UBI than a standard policy. Allstate, Farmers, Liberty Mutual, and Travelers offer up to 30% UBI savings, while Nationwide provides the biggest discount of up to 40%.

Top Usage-Based Auto Insurance (UBI) Programs| Company | Program Name | Savings | How It's Tracked |

|---|---|---|---|

| Drivewise® | 30% | Mobile App | |

| KnowYourDrive | 15% | Mobile App |

| Signal® | 30% | Mobile App | |

| DriveEasy | 25% | Mobile App | |

| RightTrack® | 30% | In-Vehicle Device |

| SmartRide® | 40% | Mobile App / In-Vehicle Device | |

| Snapshot® | $231/yr | Mobile App | |

| Drive Safe & Save™ | 20% | Mobile App / In-Vehicle Device | |

| IntelliDrive® | 30% | Mobile App | |

| SafePilot / SafePilot Miles | 20% for low mileage + 20% safe driving | Mobile App (DriveSafe / SafePilot App) |

Progressive’s Snapshot saves about $231 a year, and USAA’s SafePilot combines safe driving and low mileage for up to 20% off, helping cautious drivers cut costs while keeping rates below the average cost of vehicle storage insurance. However, some telematics programs can raise rates for bad driving habits or driving at night.

Depending on your driving history, you may not qualify for UBI discounts. It’s important to shop around and compare different types of auto insurance savings. Choosing discounts that match your lifestyle can help you maximize coverage and reduce costs.

More Discounts for Drivers With Stored Vehicles

Auto insurers offer discounts based on vehicles, driving habits, personal factors, and types of vehicle storage. Savings come from safety features, garaging, or hybrid cars, as well as safe driving, good credit, continuous coverage, or bundling policies.

Most Common Auto Insurance Discounts| Vehicle Discounts | Driver Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

Personal discounts apply to students, military, homeowners, married couples, and more. Stacking these options helps drivers cut costs while keeping solid coverage. Garaging discounts range from 7% to 18%, with bigger savings when combined with bundling, mileage, or usage-based programs outlined in our guide to car insurance discounts you can’t miss.

Top Auto Insurance Discounts for Garaged Vehicles| Insurance Company | Bundling | Claims- Free | Garaging | Low Mileage | Usage- Based |

|---|---|---|---|---|---|

| 25% | 10% | 18% | 30% | 30% | |

| 25% | 15% | 10% | 20% | 15% |

| 20% | 9% | 12% | 10% | 30% | |

| 25% | 12% | 8% | 30% | 25% | |

| 25% | 8% | 11% | 30% | 30% |

| 20% | 14% | 10% | 20% | 40% | |

| 10% | 10% | 15% | 30% | $231/yr | |

| 17% | 11% | 7% | 30% | 30% | |

| 13% | 13% | 9% | 20% | 30% | |

| 10% | 20% | 12% | 20% | 30% |

USAA, Geico, Allstate, and Liberty Mutual provide some of the best overall value for car insurance. Progressive offers a 15% discount for vehicle garaging, making it ideal for stored cars. State Farm focuses on mileage and usage-based savings, with discounts reaching up to 30%.

Find the Top Auto Insurance Providers for Garaging Discounts

Finding the best discounts for vehicle garaging and storing can significantly reduce insurance costs. Of the top options, Allstate, Progressive, and USAA have strong discount programs and some of the cheapest car insurance options available. Allistate is our top pick with savings up to 18%.

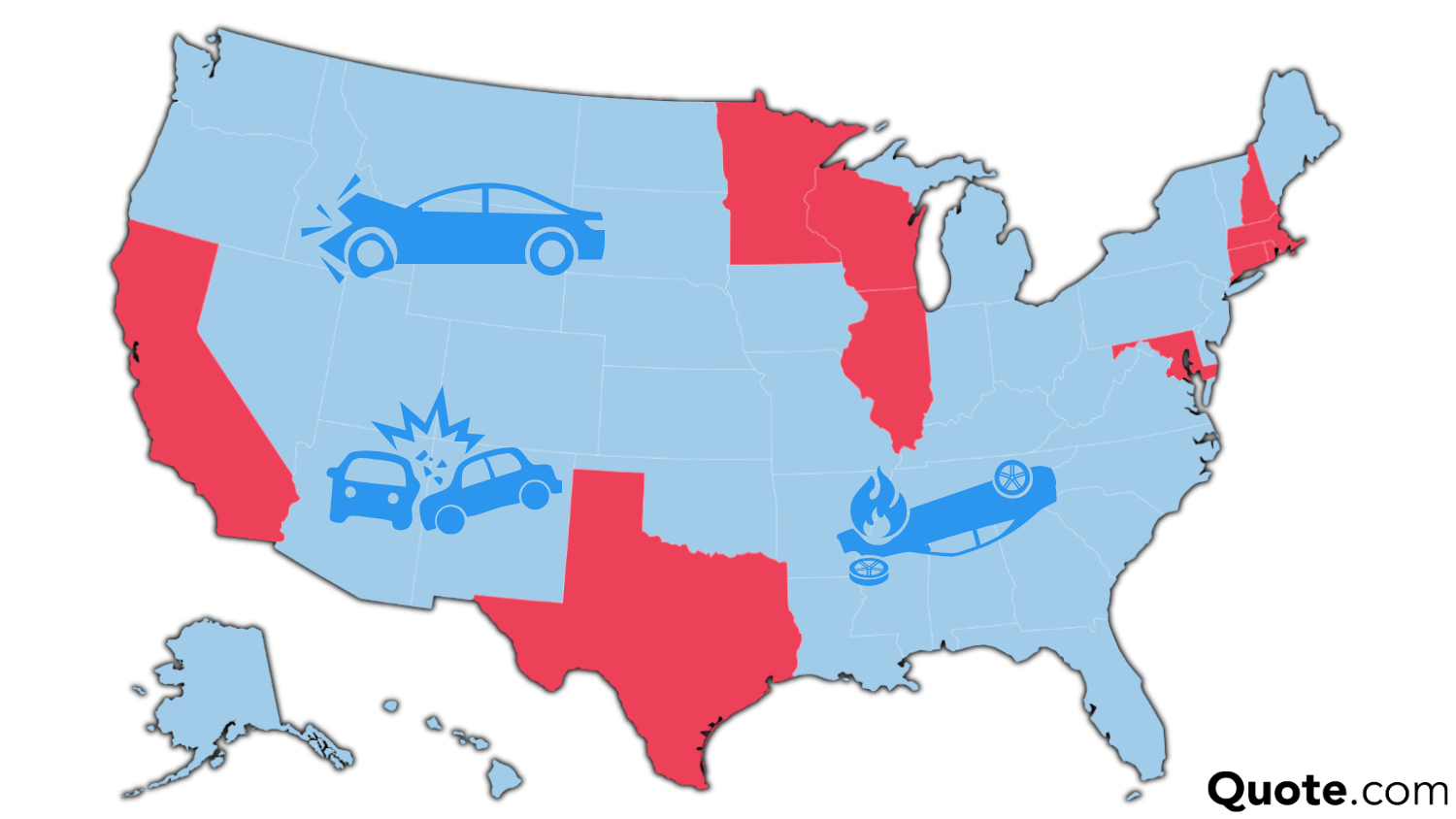

The five largest auto insurance providers offering garaging discounts control 59% of the U.S. market, with the remaining 41% held by smaller insurers. State Farm and Geico are the most popular providers, followed by Progressive, Allstate, and USAA.

As one of the largest companies, Allstate offers competitive discounts for vehicle garaging and low-mileage drivers. USAA offers the lowest premiums for eligible drivers in the military, and Progressive delivers notable garaging and usage-based savings.

Major insurers lead the market, but regional companies may offer better garaging discounts tailored to your location and driving needs.

Melanie Musson Published Insurance Expert

This shows that while national carriers dominate, many regional and niche companies also compete by offering valuable garaging savings. Compare quotes from multiple companies and combine discounts to secure affordable coverage. Enter your ZIP code into our free comparison tool to find the best insurance discounts for vehicle garaging and storing near you.

Frequently Asked Questions

What is a vehicle garaging and storing discount?

Drivers can earn discounts for vehicle garaging and storing if they park their car in a garage or secure storage facility and drive less than the average 13,000 miles per year. Some providers cap garaging discount mileage at 7,500 annual miles.

Who has the best vehicle garaging and storing discount?

Allstate, USAA, and Progressive have the best discounts for vehicle garaging and storing. Allstate has the biggest discount of 18%, but USAA combines cheap rates with 12% garaging discounts. See our USAA insurance review for details.

Does a garaging discount apply to all types of vehicles?

A garaging discount does not apply to every type of vehicle, but most insurers extend it to common personal vehicles like cars, SUVs, and trucks that are parked in a garage or secure storage. Enter your ZIP code into our free quote tool to compare top providers and discover the best auto insurance discounts near you.

How do you qualify for secure garaging and storing discounts?

You can secure garaging and storing discounts by parking your vehicle in a garage or secure storage, then comparing rates from top providers like Allstate, Progressive, and USAA that offer up to 18% savings. Get a complete view in our Progressive auto insurance review.

Can I get a garaging discount if I live in an apartment without a garage?

Yes, you may still qualify for a garaging discount if you live in an apartment without a garage, as many insurers extend savings when you park in a private driveway, a secure lot, or another safe storage area that lowers the risk of theft or damage.

Do I need to garage my car every night to qualify for the discount?

No, you don’t need to garage your car every single night to qualify for the discount, but insurers generally expect your vehicle to be parked in a garage or secure storage on a regular basis since this lowers risks like theft, vandalism, and damage.

Can I combine the garaging discount with other insurance discounts?

Yes, you can combine the garaging discount with other insurance discounts, such as the best low-mileage auto insurance discounts, bundling, or safe driving programs, to maximize savings and secure more affordable coverage.

Will the garaging discount affect my coverage in case of theft or damage?

No, the garaging discount will not reduce your coverage in the event of theft or damage. It simply lowers your premium because insurers see vehicles parked in a garage or secure storage as less risky. Your protection remains the same whether or not you receive the discount.

How does location affect stored car insurance costs?

Storage facilities in urban areas or high-demand regions could increase rates if there is a lot of theft in the area. Our guide on how to buy auto insurance highlights location as one of the biggest factors affecting insurance costs.

What is the cheapest way to store a car?

The cheapest way to store a car is by keeping it in your own garage or driveway, as it avoids storage rental fees while still offering protection from theft, vandalism, and weather damage.

What happens if I stop garaging my car but don’t inform my insurer?

How much does vehicle storage cost?

How much are storage fees for repo cars?

Do security features affect affordable vehicle storage costs?

Is the impact of garaging or storing your vehicle on auto insurance coverage greater in urban areas?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.