How to Get Life Insurance Quotes in 2026

If you're wondering how to get life insurance quotes, assess your coverage needs, such as income replacement or debts. Then compare providers and shop for life insurance quotes online to see your options. The most common policy chosen is term life insurance, with quotes starting at $30 a month.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated September 2025

How you get life insurance quotes begins with assessing your coverage needs, such as replacing income or paying debts. You should then compare the best life insurance companies, review policy types like term, whole, or universal, and factor in age, health, and lifestyle.

- Step #1: Assess Your Needs – Estimate coverage needs

- Step #2: Pick a Policy Type – Choose an insurance option

- Step #3: Compare Providers – Check rate differences

- Step #4: Provide Information – Share personal info

- Step #5: Apply & Review – Complete & confirm policy

Knowing these details helps you secure coverage that fits your budget while providing the right protection for your family.

See how much you could save every month by using our free life insurance quote generator and learn how to get life insurance quotes that fit your budget and coverage needs.

5 Easy Steps to Get Life Insurance Quotes

Getting life insurance quotes is more than filling out a form. Understanding how to compare life insurance quotes helps you evaluate your family’s financial needs, choose the right policy type, and review providers to see what fits.

Steps to Get a Life Insurance Quote

| Step | Action | Details |

|---|---|---|

| #1 | Assess Your Needs | Estimate coverage for family or debts |

| #2 | Choose Policy Type | Pick term, whole, or universal |

| #3 | Compare Providers | Shop different insurers |

| #4 | Gather Information | Age, health, lifestyle, coverage amount |

| #5 | Request Quotes | Use websites, agents, or brokers |

| #6 | Review Options | Adjust terms or add riders |

| #7 | Apply or Get Exam | Submit form and take medical test if needed |

By providing accurate details and completing the application process, you can secure coverage that matches your long-term goals.

Step #1: Assess Your Coverage Needs

The first step in getting a life insurance quote is to carefully assess how much life insurance coverage your family would need if you weren’t there to provide for them. (Read more: Whole vs. Term Life Insurance)

Think about ongoing income replacement, any debts like a mortgage, and future expenses such as childcare or tuition.

- Buying Life Insurance

The best way to get life insurance quotes is to know your coverage needs first, then compare providers to see which policy fits your budget and goals.

Michelle Robbins Licensed Insurance Agent

For example, many families aim for coverage that equals at least 10 times their annual income, but your situation may require more or less. Having a clear coverage amount in mind will help you request accurate quotes and avoid underinsuring or overpaying.

Step #2: Pick a Policy Type

After you’ve figured out how much life insurance you need, the next step is deciding what type of life insurance makes the most sense. Use a life insurance comparison chart to find the right policy for your lifestyle.

Types of Life Insurance: Key Details| Type | Coverage | Details |

|---|---|---|

| Term Life | Set period (10–30 yrs) | Low cost, no cash value |

| Whole Life | Lifetime with cash value | Fixed premiums, lifelong |

| Universal Life | Flexible lifetime growth | Adjustable premiums, loan |

| Variable Life | Lifetime, investment focus | Growth potential, market risk |

| Final Expense | Small funeral coverage | $5k–$25k, easy approval |

| Guaranteed Issue | No exam, guaranteed | High cost, low coverage |

| Group Life | Employer/group coverage | Low cost, ends with job |

A term life policy is usually the most affordable and gives you protection for a set number of years, while whole life and universal life last a lifetime and build cash value along the way. The most common type of life insurance is a 20-year term life policy, which is also the cheapest.

Compare what you can manage to comfortably pay now with your long-term financial strategy. So that when you’re buying for life insurance, you’ll be able to determine whether all you need is a simple term life policy or whether a permanent option is the better bet for long-term protection.

Step #3: Compare Providers

Once you know the policy type, it’s time to shop around. Rates vary significantly among insurers and policy types. For instance, Banner Life is the cheapest for term life at $30 per month, while AIG is the cheapest for whole life insurance at $235 per month.

Life Insurance Monthly Rates by Policy Type| Insurance Company | 20-Year Term | Whole Policy |

|---|---|---|

| $35 | $225 | |

| $30 | $230 |

| $35 | $245 | |

| $40 | $255 |

| $38 | $265 | |

| $36 | $235 | |

| $42 | $275 | |

| $44 | $285 | |

| $37 | $250 | |

| $33 | $240 |

Comparing companies side by side lets you see not just premiums, but also financial ratings, policy flexibility, and available riders. This step ensures you’re not overpaying for the same level of protection while helping you finance what your health insurance won’t cover through added life insurance benefits.

Step #4: Provide Accurate Information

When requesting quotes, accuracy matters. Insurers use personal details, such as your age, health history, tobacco use, and lifestyle habits, to calculate your premium, which is why understanding how to calculate life insurance rates is essential for getting a fair and realistic quote.

For example, someone in excellent health might secure a 20-year term policy for $28 monthly, while the same coverage could jump to $57 or more if you have a poor health record or high-risk medical history.

20-Year Term Life Insurance Monthly Rates by Health Condition| Insurance Company | Excellent | Good | Average | Poor |

|---|---|---|---|---|

| $30 | $35 | $42 | $55 | |

| $28 | $34 | $43 | $57 |

| $33 | $38 | $47 | $62 | |

| $33 | $38 | $45 | $59 |

| $34 | $39 | $46 | $60 | |

| $32 | $37 | $44 | $60 | |

| $35 | $40 | $48 | $65 | |

| $36 | $42 | $50 | $67 | |

| $34 | $39 | $46 | $58 | |

| $31 | $36 | $44 | $56 |

Being honest up front prevents surprises during underwriting and helps you lock in the most realistic rates, a point often highlighted in the complete guide to health insurance when comparing coverage options.

Step #5: Apply & Review

After you’ve compared your options, the next step is to submit an application. Some insurers can give you instant approval if your information checks out, while others may ask for a medical exam before finalizing your rate. Once you’re approved, take time to read through the policy documents so you know exactly what your coverage amount, premium, and any riders include.

Finishing this step gives your family the protection they need, and using resources like the life insurance guide can help you walk through how to get life insurance for yourself, so you know what to expect as you finalize your policy.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Impacting Your Life Insurance Quotes

Life insurance rates are determined by your age and gender, with men paying slightly more than women for the same amount of coverage. Applicants in their 20s and 30s get the best life insurance quotes, but rates go up as you get older. Life insurance quotes for seniors are usually the most expensive.

A 30-year-old male might pay just $19 per month for coverage, but that jumps to $98 monthly by age 60. For women, it is again similar, with monthly rates beginning at $16 at age 30 and rising to $140 a month at 70.

The type of life insurance you buy also makes a big difference in monthly costs. Whole life insurance costs hundreds more per month than term life policies. This kind of variation shows why comparing multiple insurers is key — you could end up paying much more for nearly identical protection if you don’t shop around.

Term vs. Whole Life Insurance Monthly Rates by Age & Gender| Age & Gender | 20-Year Term | Whole Policy |

|---|---|---|

| 20-Year-Old Female | $18 | $145 |

| 20-Year-Old Male | $21 | $160 |

| 30-Year-Old Female | $20 | $170 |

| 30-Year-Old Male | $23 | $190 |

| 40-Year-Old Female | $30 | $250 |

| 40-Year-Old Male | $35 | $280 |

| 50-Year-Old Female | $65 | $420 |

| 50-Year-Old Male | $80 | $480 |

| 60-Year-Old Female | $150 | $700 |

| 60-Year-Old Male | $210 | $850 |

| 70-Year-Old Female | $320 | $1,250 |

| 70-Year-Old Male | $450 | $1,500 |

Premiums go up drastically as you age, and purchasing when you’re young can set you up with the best rates and make long-term life insurance much more affordable.

Enter your ZIP code to compare free life insurance quotes and lock in lower rates while you’re still eligible for the best pricing.

Read More: Mutual of Omaha Insurance Review

Buying Life Insurance Online

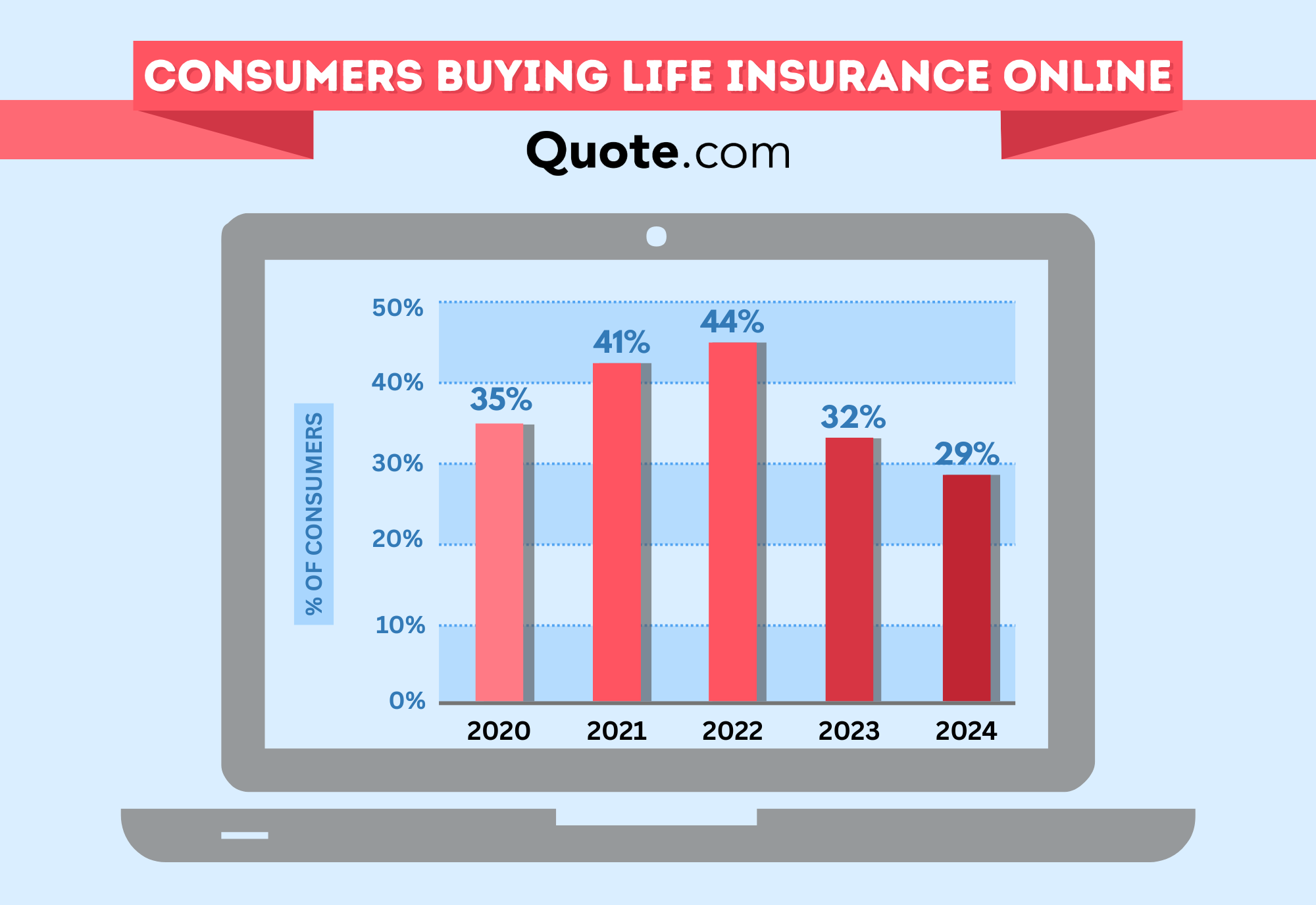

Learning how to get a life insurance quote online through insurer websites or comparison platforms allows you to view real rates from multiple companies without relying only on in-person meetings.

Some insurers even offer “no exam” options online, where approval can be based on your digital application and medical records rather than an in-person test.

Many sites allow you to enter basic details, like age, health history, and coverage amount, to get instant quotes and a clear idea of what to expect before you apply.

Schimri Yoyo Licensed Agent & Financial Advisor

This shift saves time, lets you review policies at your own pace, and puts you in control of choosing the coverage that matches both your budget and long-term needs.

Learn More: What is a Modified Endowment Contract?

Best Way to Get Life Insurance Quotes

Here is a table that shows what the primary factors are that insurers base money on when you get life insurance quotes, and it’s relatively straightforward once the onion is peeled. Age and gender are huge pricing factors, and the younger you are, the lower the rates you’ll typically pay. Your health history is another big factor, so it’s best to be upfront about any medical conditions so you won’t be surprised later.

What You Need to Get a Life Insurance Quote| Details | Reason | Insight |

|---|---|---|

| Age & Gender | Key pricing factor | Younger = cheaper |

| Health History | Impacts eligibility and rates | Disclose honestly |

| Lifestyle Habits | Risk-based pricing | Risky hobbies = higher cost |

| Coverage Amount | Determines base premium | Use online calculators |

| Policy Preference | Affects policy features and term | Choose based on life goals |

Lifestyle habits matter too — if you enjoy risky hobbies like rock climbing, expect to pay more. The amount of coverage you choose sets your base premium, so using online calculators can give you a realistic idea of costs. Ultimately, your policy preference determines the features and terms of your plan, so it’s essential to select one that aligns with your financial objectives. This way, you’re not just buying coverage — you’re buying the right kind of protection for your situation.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Right Way to Get Life Insurance Quotes

It’s easy to get a life insurance quote, so long as you know what you’re doing. You begin by determining how much coverage you actually need to provide for your family or to cover debts. From there, select a type of policy like term, whole, or universal life insurance that works for your budget and long-term goals.

Where to Get Life Insurance Quotes| Source | How it Works | Best for |

|---|---|---|

| Company Website | Direct quote from insurer | Brand-specific options |

| Comparison Site | Quotes from many insurers | Fast, side-by-side results |

| Independent Agent | Personalized help, many companies | Custom guidance |

| Captive Agent | One insurer only | Detailed product insight |

| Employer Group Plan | Offered via work | Low-cost, limited options |

From there, the process is to shop around among providers, because rates and options vary widely. By heading directly to a company website, you pull quotes from that insurer directly — which is great if you know you’re interested in that particular brand. It helps to learn how to analyze insurance companies so you can look beyond price and understand their financial strength, customer service, and policy flexibility before choosing the best fit.

Independent agents offer more personalized help since they can pull quotes from many companies, while captive agents represent just one insurer but can explain that company’s products in detail. Employer group plans are another option, often low-cost and convenient through work, though they usually come with fewer choices and may not transfer if you change jobs.

However, comparison sites make it easier for you to make quick price comparisons by allowing you to see several insurers at once. We are here to help you find the best life insurance quotes with our free quote generator.

Frequently Asked Questions

How do I get the best life insurance quotes?

The easiest way to secure a great life insurance quote is to begin with a good estimate of your coverage needs and then compare rates from at least three providers. The more honest you are about your health, lifestyle, and age, the more realistic your offers will be. Pricing across multiple companies means you don’t overpay for the same coverage.

What do you need for a life insurance quote?

To request a quote, you’ll typically need to provide your age, gender, health history, tobacco use, family medical history, and the amount of coverage you want. Insurers may also ask about your occupation and hobbies since risky activities can raise your rate. Having this information ready speeds up the process.

What type of life insurance is best?

The right policy depends on your goals. Term life is best if you need affordable protection for a set period, such as while paying off a mortgage. Whole or universal life may work better if you want lifetime coverage with cash value growth. Many families choose term because it balances cost with protection (Learn More: Whole vs. Term Life Insurance).

What is the cheapest way to get life insurance?

How do you get the cheapest life insurance quotes possible? The most affordable option for most people is term life insurance, especially if you buy it in your 20s or 30s while healthy. Online quote comparison tools can help you quickly see which insurers offer the lowest monthly premiums for the coverage amount you need.

At what age is life insurance cheapest?

Life insurance is cheapest in your 20s and 30s when you’re generally healthiest. A healthy 25-year-old might pay under $20 per month for a 20-year term policy, while the same coverage could cost hundreds of dollars at age 60 or older.

What is the easiest life insurance to qualify for?

Guaranteed issue life insurance is the easiest since it doesn’t require a medical exam, and approval is automatic. However, premiums are high, coverage is usually capped at $25,000 or less, and there may be a waiting period before full benefits apply.

Who is the most trustworthy life insurance company?

Trustworthy insurers are those with strong financial ratings and a history of paying claims reliably. Companies like State Farm, Guardian, and Northwestern Mutual consistently receive high marks from A.M. Best and J.D. Power for financial strength and customer satisfaction. See full ratings in our State Farm Insurance review.

How much will life insurance cost?

Your cost depends on age, health, gender, and policy type. For example, a healthy 40-year-old might pay about $30 to $35 per month for a term policy, while whole life coverage at the same age could cost more than $250 per monthly.

Which type of life insurance is typically cheaper?

Term life insurance is usually the cheapest option because it only provides coverage for a set number of years and doesn’t build cash value. Whole and universal life policies are more expensive since they last a lifetime and include a savings or investment component.

How much is a $25,000 life insurance policy?

A $25,000 policy, often sold as final expense or burial insurance, can cost anywhere from $15 to $100 per month, depending on your age and health. Younger applicants may pay on the low end, while seniors or those with health conditions may see higher premiums. Enter your ZIP code to see how much life insurance costs near you.

How much money do I need for life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.